Market Trends

Key Emerging Trends in the Private 5G as a Service Market

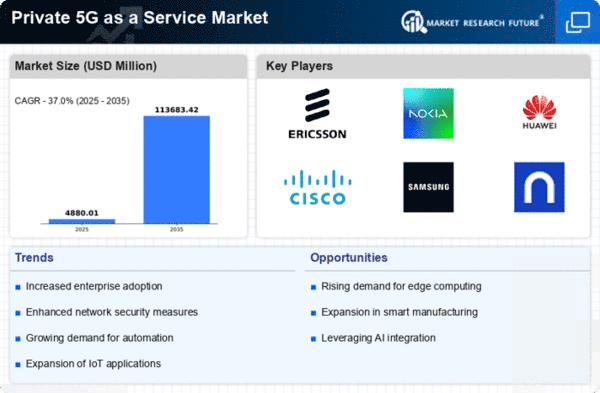

The Private 5G as a Service market is witnessing several noteworthy trends that reflect the ongoing evolution of this dynamic industry. One prominent trend is the increasing adoption of Private 5G networks in various industries. As businesses recognize the need for ultra-reliable, low-latency connectivity, Private 5G solutions are becoming integral to sectors like manufacturing, healthcare, logistics, and beyond. This trend signifies a growing acknowledgment of the unique benefits that Private 5G networks offer, including enhanced security, customization options, and high-performance connectivity tailored to specific industry requirements.

Edge computing integration is emerging as a key trend within the Private 5G market. Organizations are realizing the importance of processing data closer to the source, reducing latency and improving overall system efficiency. Private 5G networks, when combined with edge computing capabilities, empower businesses with the ability to deploy applications and services that demand real-time data analysis. This trend is particularly relevant for applications like augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT), driving the demand for Private 5G solutions with integrated edge computing capabilities.

Security remains a top priority, and a notable trend is the continuous enhancement of security features in Private 5G networks. As cyber threats become more sophisticated, businesses are placing a premium on secure communication networks. Private 5G networks, with their dedicated infrastructure and advanced encryption protocols, provide a robust solution to safeguard sensitive data and communications. The trend towards fortifying security features in Private 5G services reflects the industry's commitment to addressing evolving cybersecurity challenges.

Another trend gaining traction is the convergence of Private 5G with other advanced technologies, such as artificial intelligence (AI) and machine learning (ML). The synergy between Private 5G networks and AI/ML applications opens up new possibilities for automation, predictive analytics, and intelligent decision-making. Businesses are exploring how the combination of Private 5G and AI can optimize operations, enhance efficiency, and unlock innovative use cases across various sectors.

5G network slicing is emerging as a transformative trend within the Private 5G market. Network slicing allows organizations to create multiple virtual networks on a shared physical infrastructure, each tailored to specific use cases with unique requirements. This trend enables businesses to efficiently allocate resources, ensuring that diverse applications coexist seamlessly on the same Private 5G infrastructure. Network slicing contributes to increased flexibility, scalability, and optimized performance, aligning Private 5G services with the varied demands of different industries.

The market is also witnessing a trend towards increased collaboration and partnerships among industry stakeholders. Companies are recognizing the value of collaboration to enhance their offerings and provide end-to-end solutions. Partnerships between Private 5G service providers, hardware manufacturers, and software developers contribute to the development of comprehensive ecosystems, fostering innovation and addressing the holistic needs of businesses adopting Private 5G solutions.

Cost optimization and the emergence of affordable Private 5G solutions are notable trends shaping the market. As technology matures and economies of scale come into play, the costs associated with deploying and maintaining Private 5G networks are expected to decrease. This trend makes Private 5G solutions more accessible to a broader range of businesses, encouraging wider adoption and market growth.

Leave a Comment