Market Analysis

In-depth Analysis of Private 5G as a Service Market Industry Landscape

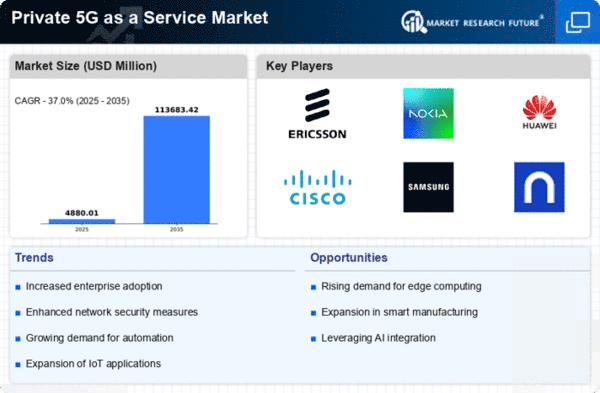

The market dynamics of the Private 5G as a Service market are shaped by a multitude of factors that collectively influence its growth and evolution. One key dynamic is the increasing demand for high-speed and reliable connectivity solutions across diverse industries. As businesses undergo digital transformations, the need for robust and secure communication networks becomes paramount. Private 5G networks address this demand by offering dedicated, high-performance connectivity, catering to the specific requirements of sectors such as manufacturing, healthcare, and logistics.

Another crucial dynamic is the ongoing technological advancements in the telecommunications industry. As the capabilities of 5G technology continue to expand, Private 5G networks benefit from the latest innovations, enabling faster data transfer, lower latency, and improved network efficiency. These advancements drive the adoption of Private 5G services as businesses seek to stay at the forefront of technological progress and leverage the competitive advantages offered by cutting-edge connectivity solutions.

The market dynamics are also influenced by the increasing emphasis on low-latency communication. Industries like manufacturing, where real-time responsiveness is critical, drive the demand for Private 5G networks. The ability to process and transmit data with minimal delay is essential for applications like robotics, automation, and IoT devices, contributing to the widespread adoption of Private 5G services across various sectors.

Security considerations constitute a significant dynamic within the Private 5G market. With the escalating frequency and sophistication of cyber threats, businesses are increasingly prioritizing secure communication networks. Private 5G networks provide an enhanced level of security, allowing organizations to safeguard their data and communications effectively. This heightened security feature becomes particularly crucial for industries dealing with sensitive information, such as healthcare, finance, and government entities.

The dynamic nature of the market is also shaped by the flexibility and customization options offered by Private 5G networks. Businesses can tailor these networks to meet their specific needs, adjusting parameters like bandwidth, coverage, and quality of service. This adaptability proves invaluable in dynamic environments where connectivity requirements may vary, enabling organizations to scale their networks based on evolving demands.

Furthermore, the integration of edge computing is a noteworthy dynamic influencing the Private 5G market. Private 5G networks, coupled with edge computing capabilities, allow organizations to process data closer to the source, reducing latency and enhancing overall system efficiency. This integration is particularly beneficial for applications requiring real-time data analysis, such as augmented reality (AR) and virtual reality (VR).

Cost efficiency is a driving force in market dynamics, impacting the adoption and growth of Private 5G services. As technology advances and economies of scale come into play, the costs associated with deploying and maintaining Private 5G networks are expected to decrease. This cost-effectiveness makes Private 5G solutions more accessible to a broader range of businesses, fostering market expansion.

The regulatory landscape forms a critical dynamic within the Private 5G market. Governments worldwide are actively shaping policies related to spectrum allocation, network deployment, and data security. Clear and favorable regulations can accelerate the adoption of Private 5G networks, while ambiguous or restrictive policies may impede growth. Industry stakeholders closely monitor and adapt to regulatory developments to navigate the evolving landscape successfully.

Leave a Comment