Market Trends

Key Emerging Trends in the Printed Signage Market

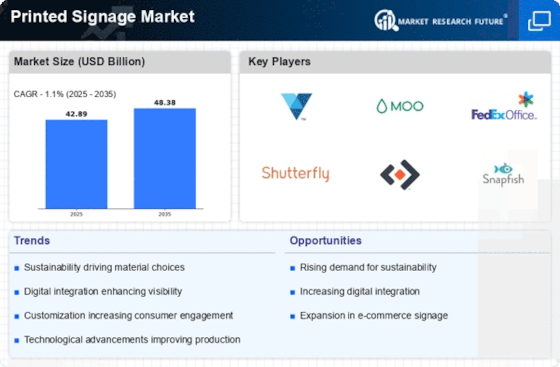

The market trends of the printed signage industry are dynamic and influenced by various factors such as technological advancements, changing consumer preferences, and economic conditions. In recent years, there has been a notable shift towards digital printing technologies in the signage market. This shift is primarily driven by the increasing demand for customized and visually appealing signage solutions. Digital printing offers greater flexibility in terms of design, allowing businesses to create eye-catching signage with vibrant colors and intricate details.

The convenience of deployment without the requirement for additional maintenance expenses is the major factor driving most organisations and companies to choose printed signage solutions.

Furthermore, advancements in printing technology have led to improved efficiency and cost-effectiveness in the production process. Traditional methods of signage production, such as screen printing, are gradually being replaced by digital printing due to its faster turnaround times and lower setup costs. Additionally, digital printing enables on-demand printing, reducing the need for large inventories and minimizing waste.

Another significant trend in the printed signage market is the growing demand for environmentally sustainable solutions. As environmental awareness increases among consumers and businesses alike, there is a greater emphasis on eco-friendly materials and production processes. Manufacturers are increasingly investing in sustainable printing technologies and utilizing recyclable materials to reduce their carbon footprint and appeal to environmentally conscious customers.

Personalization is also driving market trends in the printed signage industry. Businesses are seeking innovative ways to engage with their target audience and differentiate themselves from competitors. Customized signage allows companies to tailor their messaging to specific demographics and create unique brand experiences. Whether it's through personalized messages, graphics, or interactive elements, personalized signage helps businesses capture the attention of consumers and leave a lasting impression.

Moreover, the rise of e-commerce and online advertising platforms has created new opportunities for the signage industry. Businesses are investing in digital signage solutions to enhance their online presence and drive foot traffic to physical locations. Digital signage offers dynamic content capabilities, allowing businesses to display real-time information, promotions, and advertisements in an engaging format.

In addition to technological advancements, demographic shifts and changing consumer behaviors are influencing market trends in the printed signage industry. As urbanization continues to rise, there is a growing demand for signage in urban areas, including retail stores, restaurants, and public spaces. Businesses are leveraging signage as a powerful marketing tool to attract customers and increase brand visibility in densely populated areas.

Furthermore, the COVID-19 pandemic has accelerated certain trends in the signage market, such as the adoption of contactless technologies and hygiene-focused signage solutions. Businesses are implementing signage strategies to communicate safety protocols, social distancing guidelines, and health precautions to customers and employees. Additionally, there is an increased demand for outdoor signage solutions as businesses adapt to outdoor dining and curbside pickup options.

Leave a Comment