Aging Population

The aging population is a crucial driver of the Prescription Drugs Market. As individuals age, they often experience a higher prevalence of chronic diseases and health conditions, necessitating increased medication use. According to recent data, the proportion of individuals aged 65 and older is projected to rise significantly, leading to a greater demand for prescription medications. This demographic shift is likely to result in a substantial increase in healthcare expenditures, particularly in the pharmaceutical sector. The Prescription Drugs Market must adapt to this growing need by developing innovative therapies and ensuring accessibility to essential medications for older adults. Furthermore, the increasing life expectancy may contribute to a longer duration of medication use, further amplifying the market's growth potential.

Advancements in Biotechnology

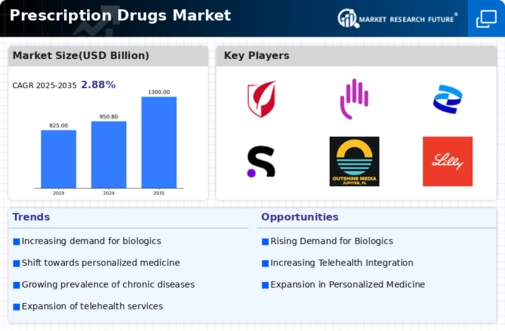

Advancements in biotechnology are transforming the Prescription Drugs Market by enabling the development of novel therapies and biologics. The integration of biopharmaceuticals into treatment regimens has led to improved patient outcomes and targeted therapies for various diseases. The market for biologics is expected to expand significantly, with projections indicating that it could account for a substantial share of the overall pharmaceutical market. These innovations not only enhance treatment efficacy but also create opportunities for personalized medicine approaches. As biotechnology continues to evolve, the Prescription Drugs Market is likely to witness an influx of new products that address unmet medical needs, thereby driving growth and competition among pharmaceutical companies.

Rising Healthcare Expenditure

Rising healthcare expenditure is a prominent driver of the Prescription Drugs Market. Increased spending on healthcare services and medications reflects a growing recognition of the importance of health and wellness. Data indicates that healthcare spending has been on an upward trajectory, with a significant portion allocated to prescription drugs. This trend is influenced by factors such as the rising prevalence of chronic diseases, advancements in medical technology, and an aging population. As healthcare systems allocate more resources to pharmaceuticals, the Prescription Drugs Market is poised for growth. Pharmaceutical companies may benefit from this trend by investing in research and development to create innovative drugs that meet the evolving needs of patients and healthcare providers.

Regulatory Changes and Policies

Regulatory changes and policies play a pivotal role in shaping the Prescription Drugs Market. Governments and regulatory bodies continuously adapt their frameworks to ensure drug safety, efficacy, and accessibility. Recent policy shifts may include expedited approval processes for new medications, which can significantly impact market dynamics. Additionally, initiatives aimed at reducing drug prices and enhancing transparency in pricing can influence market competition. These regulatory developments may create both challenges and opportunities for pharmaceutical companies. The Prescription Drugs Market must navigate this complex landscape to ensure compliance while also leveraging new policies to enhance market access and patient care.

Increased Focus on Preventive Healthcare

Increased focus on preventive healthcare is emerging as a vital driver of the Prescription Drugs Market. As healthcare systems shift towards preventive measures, there is a growing emphasis on early intervention and management of health conditions. This trend is likely to lead to an increase in the prescription of medications aimed at preventing diseases rather than solely treating them. Data suggests that preventive healthcare strategies can reduce long-term healthcare costs and improve patient outcomes. Consequently, the Prescription Drugs Market may experience a surge in demand for preventive medications, such as vaccines and prophylactic treatments. This shift not only enhances public health but also presents new opportunities for pharmaceutical innovation and market expansion.