Regulatory Support and Guidelines

Regulatory bodies play a crucial role in shaping the Prenatal Screening Tests Devices Market. The establishment of supportive guidelines and regulations by health authorities encourages the development and adoption of innovative screening technologies. For instance, the introduction of streamlined approval processes for new devices has facilitated quicker market entry for advanced prenatal screening solutions. This regulatory support is expected to foster a competitive environment, driving innovation and improving the quality of prenatal care. As a result, the market is anticipated to expand, with an estimated increase in device adoption rates by 15% over the next few years.

Rising Incidence of Genetic Disorders

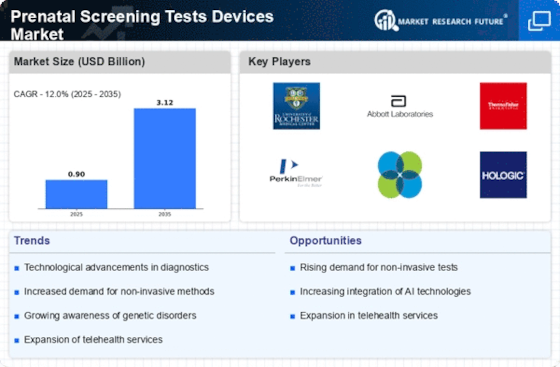

The increasing incidence of genetic disorders is a significant driver for the Prenatal Screening Tests Devices Market. As the prevalence of conditions such as Down syndrome and other chromosomal abnormalities rises, the demand for effective screening solutions becomes more pronounced. This trend is further exacerbated by factors such as advanced maternal age, which is associated with higher risks of genetic anomalies. Consequently, the market is expected to experience a robust growth trajectory, with an estimated compound annual growth rate of 12% as healthcare providers seek to implement comprehensive screening protocols to address these challenges.

Increasing Awareness of Prenatal Health

The rising awareness regarding prenatal health is a pivotal driver for the Prenatal Screening Tests Devices Market. As more expectant parents become informed about the importance of early detection of genetic disorders and congenital anomalies, the demand for prenatal screening devices is likely to surge. Educational campaigns and healthcare initiatives have contributed to this awareness, leading to a projected growth rate of approximately 10% annually in the market. This heightened focus on prenatal health not only encourages expectant parents to seek screening but also prompts healthcare providers to adopt advanced technologies, thereby enhancing the overall market landscape.

Technological Innovations in Screening Devices

Technological innovations are transforming the Prenatal Screening Tests Devices Market. The integration of artificial intelligence and machine learning into screening devices enhances accuracy and efficiency, allowing for earlier detection of potential issues. These advancements not only improve patient outcomes but also increase the appeal of prenatal screening among healthcare providers. The market is witnessing a shift towards more sophisticated devices, with a projected increase in sales of AI-driven screening tools by 20% in the coming years. This trend indicates a growing reliance on technology to facilitate better prenatal care.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a vital driver for the Prenatal Screening Tests Devices Market. Governments and private entities are increasingly allocating resources to enhance maternal and child health services, which includes the procurement of advanced prenatal screening devices. This investment not only improves access to quality prenatal care but also encourages the adoption of innovative technologies. As healthcare systems evolve, the market is likely to benefit from increased funding, leading to a projected growth in device availability and utilization by approximately 18% over the next few years.