Market Trends

Key Emerging Trends in the Predictive Genetic Testing and Consumer Wellness Genomics Market

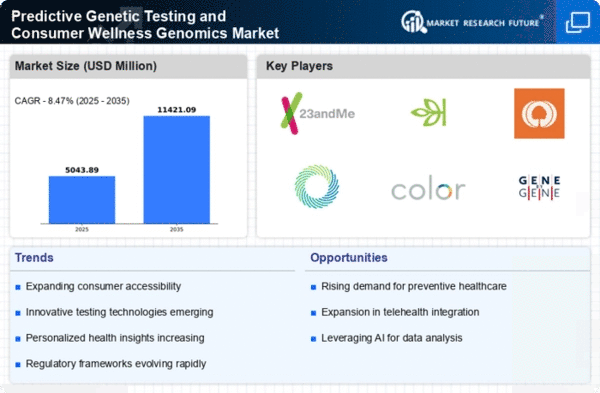

As genetic technology allows people to understand their genes, predictive genetic testing and consumer wellness genomics are growing. These patterns show the increased interest in customized healthcare and genetically-based well-being management. Direct-to-consumer genetic testing is growing, letting people get genetic information without healthcare middlemen. This movement democratizes genetic testing, allowing individuals to query at-home testing kit providers about ancestry, health, and wellbeing. Consumer wellness genomics goes beyond ancestry testing. Companies provide complete genetic insights on health, diet, exercise, and skincare. Demand for holistic genetic information to support individualized lifestyle decisions is rising. Predictive genetic testing is using AI. AI systems evaluate large genomic datasets to provide more precise and thorough genetic interpretations. Health risk forecasts and wellness suggestions are more accurate, improving genetic knowledge. Risk assessment for illness is becoming more important in predictive genetic testing. Consumers are increasingly interested in their genetic predispositions to common and unusual illnesses. Genetic findings informed this proactive illness prevention and early intervention movement. Pharmacogenomics is growing in consumer wellness genomics. Genetic testing helps doctors personalize drugs for maximum effectiveness and minimal negative effects. This trend advances genetically-based individualized therapy. Data security and privacy are becoming more important as genetic data becomes more accessible. The predictive genetic testing sector is taking strong precautions to protect customer genetic information from illegal access and comply with privacy laws. Genetic knowledge is a consumer wellness genomics market focus. Companies are investing in educational activities to better customers' comprehension of genetic information, including how to evaluate findings and make educated choices based on genetic insights. This movement educates people to appropriately manage their genetic data. Consumer genomics firms and healthcare providers are collaborating more. Genetic information should be integrated into healthcare management, as this trend shows. Consumer genomics firms engage with healthcare experts to integrate genetic findings into tailored healthcare regimens. Continuous innovation and research define the predictive genetic testing industry. Scientific advances expand consumer genetic test options. This guarantees customers have access to cutting-edge genetic information as genomics evolves.

Leave a Comment