Precision Fermentation Ingredients Size

Precision Fermentation Ingredients Market Growth Projections and Opportunities

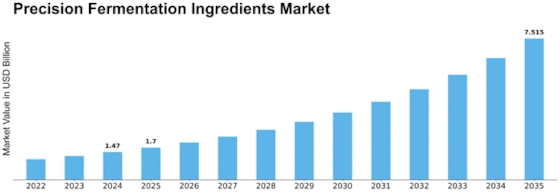

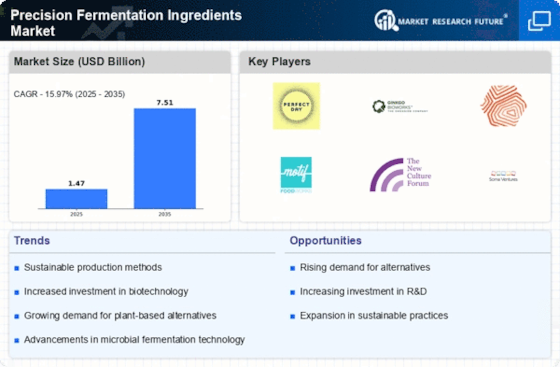

The global fermentation ingredients market is poised for substantial growth, projected to reach a valuation of USD 78.38 billion by the year 2023, exhibiting a Compound Annual Growth Rate (CAGR) of 5.08%. This forecast underscores the industry's robust potential and the increasing significance of fermentation ingredients across diverse sectors. One of the key driving forces behind this growth is the expanding application of fermentation ingredients in the food and beverage industry, paving the way for innovation and market expansion.

As of 2017, the market dynamics indicate a notable distribution of market share, with the Americas commanding a substantial portion at approximately 39.55%, closely followed by the Asia-Pacific (APAC) region with a share of about 29.92%. This regional distribution underscores the global reach and influence of fermentation ingredients, with the Americas emerging as a dominant player in the market landscape. The Americas, particularly North America, have witnessed a surge in demand for fermentation ingredients, primarily driven by their extensive use in the food and beverage sector.

Looking ahead, the Americas are expected to maintain their leading position, projecting a higher growth rate of approximately 5.79% during the forecast period. This accelerated growth can be attributed to the escalating demand for fermentation ingredients, particularly in the context of their application in food and beverage processes. The Americas, comprising the United States and other key economies, are witnessing a shift in consumer preferences towards healthier and more sustainable food options, driving the adoption of fermentation ingredients as essential components in the production of a wide array of food and beverage products.

In Europe, the fermentation ingredients market held a market share of 22.78% in 2017, and it is anticipated to reach a valuation of USD 17.08 billion by 2023. The growth in the European market is influenced by the burgeoning chemical and pharmaceutical industries in the region. The adoption of fermentation ingredients in these industries is driven by their versatile applications, including the production of antibiotics, enzymes, and other bio-based products. As sustainability becomes a focal point for various industries, the use of fermentation ingredients aligns with the overarching goal of reducing environmental impact and promoting eco-friendly manufacturing processes.

The steady growth of the fermentation ingredients market is indicative of their increasing importance in various industrial sectors, beyond food and beverage. The applications extend to pharmaceuticals, chemicals, biofuels, and more, showcasing the versatility of these ingredients in fostering sustainable practices. The pharmaceutical industry, in particular, leverages fermentation ingredients for the production of antibiotics, vaccines, and other therapeutic compounds, contributing to advancements in healthcare.

In the context of the food and beverage industry, the adoption of fermentation ingredients is driven by their role in enhancing flavor profiles, improving texture, and prolonging shelf life. The fermentation process involves the use of microorganisms to transform raw materials into valuable products, contributing to the development of unique and desirable characteristics in food and beverages. This aligns with the evolving consumer preferences for natural and clean-label products, propelling the demand for fermentation ingredients.

The projected growth of the fermentation ingredients market is also influenced by advancements in biotechnology and increased research and development activities. The exploration of novel fermentation processes and the identification of new microorganisms with unique capabilities contribute to the expansion of the market. This dynamic landscape fosters innovation, encouraging manufacturers to explore and capitalize on emerging opportunities within the fermentation ingredients space.

The global market for fermentation ingredients is characterized by a continual quest for sustainable solutions and eco-friendly practices. Fermentation, as a biological process, aligns with the principles of green chemistry and circular economy models, making it a preferred choice for industries seeking environmentally conscious alternatives. The fermentation ingredients market, therefore, stands at the intersection of technological innovation, industrial sustainability, and consumer-driven demand for high-quality products.

In conclusion, the global fermentation ingredients market is on a trajectory of significant growth, with a projected valuation of USD 78.38 billion by 2023 and a CAGR of 5.08%. The Americas, particularly North America, currently dominate the market share, driven by the escalating demand for fermentation ingredients in the food and beverage sector. Europe, propelled by its robust chemical and pharmaceutical industries, is poised for substantial growth. The multifaceted applications of fermentation ingredients, coupled with advancements in biotechnology, position this market as a key player in driving innovation, sustainability, and the evolution of diverse industries globally.

Leave a Comment