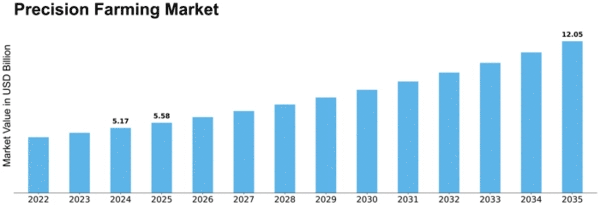

Precision Farming Size

Precision Farming Market Growth Projections and Opportunities

Technology is a major market factor driving the adoption of precision farming. The use of such cutting-edge technologies as GPS, sensors, drones, and data analytics enanbles farmers to collect real-time data about their fields. By applying this information, they can make better decisions regarding crop cultivation, irrigation, fertilization, other applications. The yields are better than those under the old management system. As the technologies become more fully developed and less expensive, precision farming becomes available to a wider group of farmers. It is being adopted on an increasing variety of agricultural landscapes as well. Concerns about the environment and demand for sustainable agriculture are also significant market forces driving precision farming. Global challenges that farmers face include climate change, water scarcity and the exhaustion of natural resources. To solve these problems, precision farming technologies offer solutions that optimize resource use and minimize environmental impact. Sustainable farming A more advanced irrigation system, as well as better targeting fertilizer application and reduced pesticide use makes for a greener style of agriculture that is gathering momentum in society at large. Another important factor in the precision farming market is the economic aspect. While such an initial investment may seem heavy, long-term cost savings and improved productivity make precision farming technologies a practical choice for many farmers. It helps promote return on the investment for precision farming technologies which should lead to reduced input costs, better resource use and higher yields. Recognizing the economic benefits, governments and financial institutions sometimes offer incentives, subsidies, or financing options to encourage farmers in precision techniques. Collaborative efforts among parties are also factors of the market. Joint ventures between technology providers, agricultural equipment manufacturers and research institutions help provide integrated precision farming products. Such collaborations boost innovation, promote knowledge exchange, and give rise to all kinds of more advanced instruments tailored precisely for the needs of farmers. These consumer preferences match up well with the concept of precision farming, which emphasizes efficiency in resource use and environmental sustainability. To meet consumer expectations for ethical and low-environment impact foods, farmers are complying with market demands by taking up the precision farming techniques.

Leave a Comment