Growing DIY Culture

The Power Tools Market is significantly influenced by the growing do-it-yourself (DIY) culture among consumers. As more individuals engage in home improvement projects, the demand for user-friendly power tools has escalated. Retailers are responding by offering a wider range of products tailored to novice users, including cordless drills and compact saws. This shift not only boosts sales but also encourages consumers to invest in quality tools for personal projects. The increasing popularity of DIY initiatives is likely to sustain market growth, as it fosters a culture of creativity and self-sufficiency.

Sustainability Trends

Sustainability is becoming a pivotal driver in the Global Power Tools Industry, as consumers and manufacturers alike prioritize eco-friendly practices. The demand for energy-efficient tools and sustainable materials is on the rise, prompting companies to innovate and adapt their product lines. For instance, manufacturers are increasingly focusing on developing tools that utilize renewable energy sources or are made from recycled materials. This trend aligns with global efforts to reduce carbon footprints and promote sustainable living, potentially influencing purchasing decisions and shaping the future landscape of the power tools market, as power tool makers increasingly adapt their strategies to meet evolving sustainability expectations.

Technological Advancements

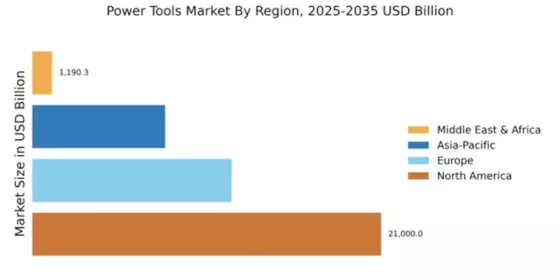

The Power Tools Industry is experiencing a surge in technological advancements, which significantly enhances product efficiency and user experience. Innovations such as brushless motors, smart tools with IoT capabilities, and improved battery technologies are becoming commonplace. These advancements not only increase the performance of power tools but also reduce energy consumption, appealing to environmentally conscious consumers. As a result, the market is projected to grow from 42190.3 USD Billion in 2024 to 82893.6 USD Billion by 2035, reflecting a robust demand for high-tech solutions in both residential and industrial applications.

Rising Construction Activities

The Power Tools Market is closely tied to the construction sector, which is witnessing a resurgence in various regions. Increased urbanization and infrastructure development projects are driving demand for power tools, as construction companies seek efficient and reliable equipment to meet project deadlines. The expansion of residential and commercial buildings necessitates the use of advanced power tools, which are essential for tasks ranging from drilling to cutting. This trend is expected to contribute to a compound annual growth rate (CAGR) of 6.33% from 2025 to 2035, further solidifying the industry's growth trajectory.

Expansion of E-commerce Platforms

The Power Tools Industry is witnessing a transformation due to the expansion of e-commerce platforms. Online retailing provides consumers with easy access to a wide variety of power tools, often at competitive prices. This shift not only enhances consumer convenience but also allows manufacturers to reach a broader audience without the constraints of traditional retail. As e-commerce continues to grow, it is expected to play a crucial role in shaping purchasing behaviors and driving sales in the power tools sector, contributing to the overall market growth.