Rising Complexity of Power Systems

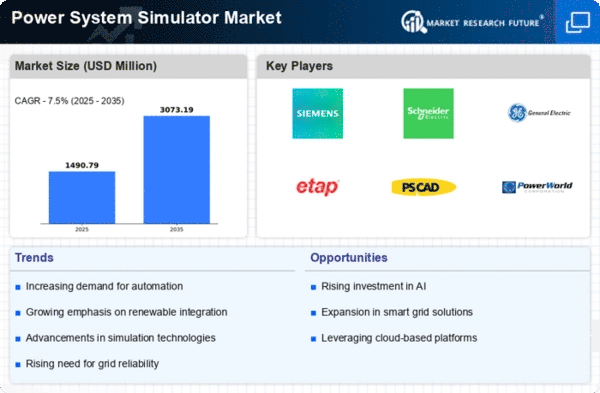

The rising complexity of power systems is a significant factor influencing the Global Power System Simulator Market Industry. As energy demands increase and the mix of generation sources diversifies, utilities face challenges in managing grid stability and reliability. Advanced simulation tools are essential for analyzing these complex interactions and ensuring optimal performance. The need for such tools is underscored by the projected market growth, with expectations of reaching 3.07 USD Billion by 2035. This complexity necessitates ongoing investment in simulation technologies, as utilities strive to maintain efficiency and reliability in an ever-evolving energy landscape.

Regulatory Support for Smart Grid Initiatives

Regulatory support for smart grid initiatives is a critical driver for the Global Power System Simulator Market Industry. Governments worldwide are increasingly implementing policies that promote the modernization of electrical grids. These initiatives often require sophisticated simulation tools to assess the impact of new technologies and regulatory changes. For instance, the push for smart meters and grid automation necessitates accurate modeling to ensure seamless integration. As a result, the market is expected to benefit from these regulatory frameworks, which not only enhance grid reliability but also encourage investment in simulation technologies, further propelling market growth.

Growing Demand for Renewable Energy Integration

The Global Power System Simulator Market Industry is experiencing a notable surge in demand due to the increasing integration of renewable energy sources. As countries strive to meet their sustainability goals, the need for advanced simulation tools becomes paramount. These tools facilitate the modeling of complex power systems that incorporate solar, wind, and other renewable sources. For instance, in 2024, the market is projected to reach 1.39 USD Billion, reflecting the urgency for utilities to optimize grid performance and reliability. This trend is expected to continue as the global energy landscape evolves, with the market anticipated to grow significantly by 2035.

Technological Advancements in Simulation Software

Technological advancements are significantly influencing the Global Power System Simulator Market Industry. Innovations in software capabilities, such as enhanced data analytics and real-time simulation, are enabling utilities to better predict and manage power flows. For example, the integration of artificial intelligence and machine learning into simulation tools allows for more accurate forecasting and decision-making. This trend is likely to drive market growth, as utilities seek to leverage these technologies to improve operational efficiency. The anticipated compound annual growth rate of 7.48% from 2025 to 2035 underscores the potential of these advancements to reshape the industry landscape.

Increased Investment in Infrastructure Development

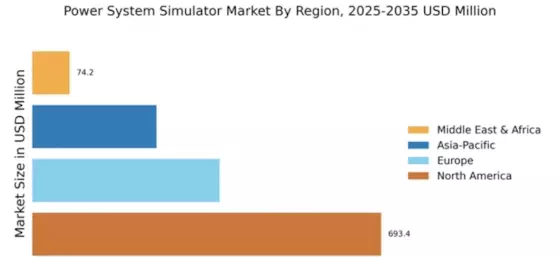

Increased investment in infrastructure development is a pivotal driver for the Global Power System Simulator Market Industry. As nations prioritize the enhancement of their energy infrastructure, the demand for simulation tools that can model and optimize these systems grows. Investments in grid expansion, modernization, and resilience are becoming more prevalent, particularly in developing regions. This trend is likely to stimulate market growth, as utilities and governments seek to ensure that their infrastructure can support future energy demands. The anticipated growth trajectory of the market, with a CAGR of 7.48% from 2025 to 2035, reflects the critical role of infrastructure investment in shaping the industry.