Growth of Electric Vehicles

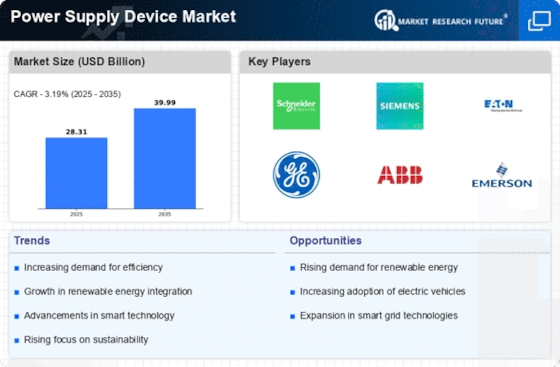

The Power Supply Device Market is significantly influenced by the rapid growth of electric vehicles (EVs). As the automotive sector shifts towards electrification, the demand for reliable and efficient power supply devices is escalating. Data indicates that The Power Supply Device Market is projected to grow at a compound annual growth rate (CAGR) of over 20% in the coming years. This growth necessitates the development of specialized power supply devices that can support EV charging infrastructure, including fast chargers and home charging solutions. The increasing adoption of EVs not only drives innovation within the Power Supply Device Market but also presents opportunities for manufacturers to cater to a burgeoning market segment.

Rising Demand for Energy Efficiency

The Power Supply Device Market is experiencing a notable increase in demand for energy-efficient solutions. As consumers and businesses alike become more conscious of energy consumption, the need for power supply devices that minimize energy waste is paramount. According to recent data, energy-efficient power supplies can reduce energy costs by up to 30%, making them an attractive option for both residential and commercial applications. This trend is further fueled by government incentives aimed at promoting energy efficiency, which encourages manufacturers to innovate and develop advanced power supply technologies. Consequently, the Power Supply Device Market is likely to witness a surge in the adoption of energy-efficient devices, aligning with broader sustainability goals.

Increasing Adoption of Renewable Energy Systems

The Power Supply Device Market is witnessing a surge in the adoption of renewable energy systems, such as solar and wind power. As countries strive to meet renewable energy targets, the need for efficient power supply devices that can manage and convert renewable energy sources is becoming critical. Data suggests that the renewable energy sector is expected to account for a significant portion of the global energy mix, with solar power alone projected to grow by over 25% annually. This shift necessitates the development of power supply devices that can efficiently handle variable energy inputs and provide stable output. Consequently, the Power Supply Device Market is likely to benefit from this transition towards sustainable energy solutions.

Regulatory Standards and Compliance Requirements

The Power Supply Device Market is increasingly shaped by regulatory standards and compliance requirements aimed at ensuring safety, efficiency, and environmental sustainability. Governments and regulatory bodies are implementing stringent guidelines that manufacturers must adhere to, particularly concerning energy efficiency and emissions. Compliance with these regulations not only enhances product credibility but also drives innovation within the industry. For instance, the introduction of energy efficiency standards has prompted manufacturers to invest in research and development to create compliant power supply devices. As these regulations evolve, the Power Supply Device Market is expected to adapt, fostering a competitive landscape that prioritizes compliance and sustainability.

Technological Advancements in Power Supply Solutions

Technological advancements are reshaping the Power Supply Device Market, leading to the development of more sophisticated and efficient power supply solutions. Innovations such as digital power management, power factor correction, and advanced thermal management are becoming increasingly prevalent. These technologies enhance the performance and reliability of power supply devices, making them suitable for a wider range of applications, from consumer electronics to industrial machinery. Furthermore, the integration of smart technologies, such as IoT connectivity, allows for real-time monitoring and control of power supply systems. As these advancements continue to evolve, the Power Supply Device Market is poised for substantial growth, driven by the demand for high-performance power solutions.