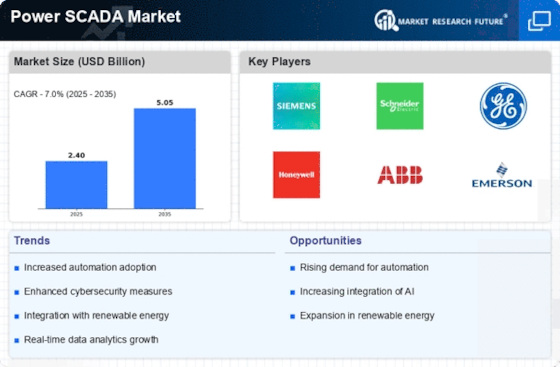

Leading market players are investing heavily in research and development to expand their product lines, which will help the Power SCADA Market grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Power SCADA industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Power SCADA industry to benefit clients and increase the market sector. In recent years, the Power SCADA industry has offered some of the most significant advantages to the Power sector. Major players in the Power SCADA Market, including ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton Corporation (Ireland), Hitachi (Japan), Rockwell Automation (US), Honeywell (US), and Toshiba Corporation (Japan) are attempting to increase market demand by investing in research and development operations. ABB is a leading provider of electrification and automation solutions. The company offers a wide range of products, systems, and services in the areas of electrification, motion, and industrial automation. It's solutions leverage engineering expertise and software to deliver reliable power, boost industrial productivity, and enhance energy efficiency. ABB distributes its products through a direct sales force and a network of third-party partners, including distributors, installers, wholesalers, machine builders, OEMs, and system integrators. Serving customers across utilities, industry, transport, and infrastructure sectors, ABB delivers digitally connected industrial equipment and systems across Asia, the Americas, the Middle East, Africa, and Europe. The company is headquartered in Zurich, Switzerland. Siemens is a technology company renowned for its operations in electrification, automation, and digitalization. The company is involved in designing, developing, manufacturing, and installing a diverse range of products and complex systems. Siemens also offers tailored solutions to meet specific customer needs. Its focus areas include power generation and distribution, as well as advanced infrastructure solutions for buildings and distributed energy systems. Additionally, Siemens provides innovative mobility solutions for both rail and road transport, along with cutting-edge medical technology and digital healthcare services. With a presence, Siemens operates research and development facilities, production plants, warehouses, and sales offices worldwide. Serving customers across various industries such as energy, healthcare, infrastructure, manufacturing, and more, Siemens is headquartered in Munich, Bavaria, Germany. Siemens Energy and Ørsted partnered in 2022 to develop the world's first AI-driven offshore wind service platform. This collaboration focuses on creating and implementing an advanced platform that utilizes artificial intelligence to monitor and optimize the efficiency of offshore wind farms.