Rising Demand for IoT Devices

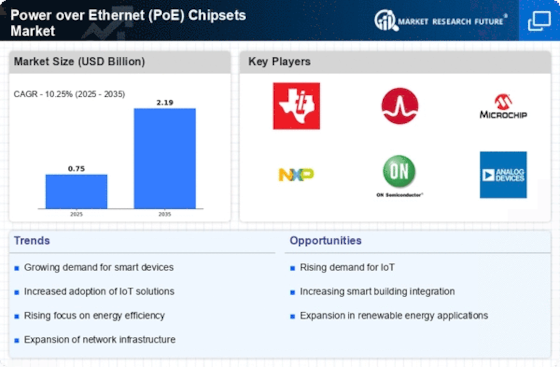

The increasing proliferation of Internet of Things (IoT) devices is a primary driver for the Power over Ethernet (PoE) Chipsets Market. As more devices require power and data connectivity, PoE technology offers a streamlined solution, eliminating the need for separate power supplies. According to recent estimates, the number of connected IoT devices is projected to reach 30 billion by 2030. This surge in IoT adoption necessitates efficient power delivery systems, thereby enhancing the demand for PoE chipsets. Furthermore, industries such as smart homes, healthcare, and industrial automation are increasingly integrating PoE technology to simplify installations and reduce costs. Consequently, the growth of IoT applications is likely to propel the PoE chipsets market, as manufacturers seek to meet the evolving needs of a connected world.

Increased Focus on Energy Efficiency

The heightened emphasis on energy efficiency is a crucial driver for the Power over Ethernet (PoE) Chipsets Market. As organizations strive to reduce energy consumption and operational costs, PoE technology presents an attractive solution by delivering power and data over a single cable. This not only simplifies installations but also minimizes energy waste. Recent studies suggest that PoE systems can reduce energy costs by up to 30% compared to traditional power delivery methods. Additionally, regulatory frameworks and sustainability initiatives are pushing businesses to adopt energy-efficient technologies. Consequently, the demand for PoE chipsets is likely to rise as companies seek to comply with energy regulations and enhance their sustainability profiles. This trend underscores the importance of energy efficiency in driving the growth of the PoE chipsets market.

Expansion of Smart Building Initiatives

The expansion of smart building initiatives is significantly impacting the Power over Ethernet (PoE) Chipsets Market. As urbanization continues to rise, there is an increasing focus on developing smart buildings that utilize advanced technologies for improved efficiency and sustainability. PoE technology plays a vital role in these initiatives by enabling the integration of various systems, such as lighting, security, and HVAC, through a single network infrastructure. Recent market analyses indicate that the smart building market is projected to reach USD 1 trillion by 2025, with PoE systems being a key component in achieving this growth. The ability to manage and control building systems through a centralized platform enhances operational efficiency and reduces costs, thereby driving the demand for PoE chipsets in smart building applications.

Advancements in Networking Infrastructure

The ongoing advancements in networking infrastructure are significantly influencing the Power over Ethernet (PoE) Chipsets Market. With the transition towards higher bandwidth requirements, particularly with the rollout of 5G technology, there is a growing need for robust networking solutions. PoE technology facilitates the deployment of high-speed data networks while simultaneously providing power to devices. Recent data indicates that the global market for networking equipment is expected to grow at a compound annual growth rate (CAGR) of 10% through 2027. This growth is likely to drive the demand for PoE chipsets, as businesses and organizations upgrade their infrastructure to support faster and more efficient connectivity. As a result, the integration of PoE technology into modern networking solutions is becoming increasingly prevalent, further bolstering the market.

Growth in Surveillance and Security Systems

The increasing focus on surveillance and security systems is a notable driver for the Power over Ethernet (PoE) Chipsets Market. As security concerns rise across various sectors, the demand for advanced surveillance solutions is escalating. PoE technology facilitates the installation of IP cameras and other security devices by providing both power and data connectivity through a single cable. This not only simplifies the installation process but also reduces costs associated with wiring. Recent reports suggest that The Power over Ethernet (PoE) Chipsets is expected to grow at a CAGR of 10% through 2026. This growth is likely to enhance the demand for PoE chipsets, as businesses and organizations seek to implement efficient and reliable security systems. The integration of PoE technology into surveillance solutions is thus becoming increasingly prevalent, further driving the market.