-

and Threat Analysis\r\n\r\n\r\n\r\n\r\n\r\n\r\nPostoperative Pain Management Market, BY Product

-

Type (USD Billion)\r\n\r\nAnalgesics\r\nLocal Anesthetics\r\nOpioids\r\nNonsteroidal Anti-Inflammatory

-

Drugs\r\nAdjuvants\r\n\r\n\r\nPostoperative Pain Management Market, BY Administration

-

Route (USD Billion)\r\n\r\nOral\r\nIntravenous\r\nTransdermal\r\nRegional\r\nSubcutaneous\r\n\r\n\r\nPostoperative Pain Management Market, BY Application

-

(USD Billion)\r\n\r\nOrthopedic Surgery\r\nCardiothoracic Surgery\r\nGeneral Surgery\r\nGynecological

-

Surgery\r\nUrological Surgery\r\n\r\n\r\nPostoperative Pain Management Market, BY End User

-

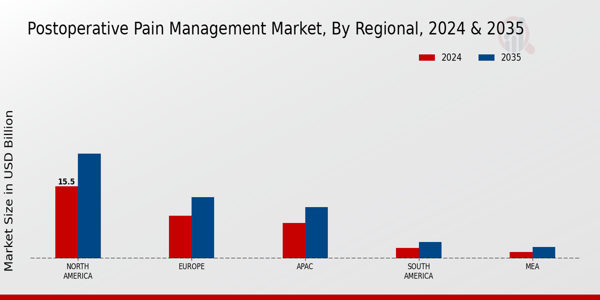

(USD Billion)\r\n\r\nHospitals\r\nAmbulatory Surgical Centers\r\nHome Care Settings\r\n\r\n\r\nPostoperative Pain Management Market, BY Regional (USD Billion)\r\n\r\nNorth America\r\n\r\nUS\r\nCanada\r\n\r\n\r\nEurope\r\n\r\nGermany\r\nUK\r\nFrance\r\nRussia\r\nItaly\r\nSpain\r\nRest

-

of Europe\r\n\r\n\r\nAPAC\r\n\r\nChina\r\nIndia\r\nJapan\r\nSouth

-

Korea\r\nMalaysia\r\nThailand\r\nIndonesia\r\nRest

-

of APAC\r\n\r\n\r\nSouth America\r\n\r\nBrazil\r\nMexico\r\nArgentina\r\nRest

-

of South America\r\n\r\n\r\nMEA\r\n\r\nGCC

-

Countries\r\nSouth Africa\r\nRest of MEA\r\n\r\n\r\n\r\n\r\n\r\n\r\nCompetitive Landscape\r\n\r\nOverview\r\nCompetitive

-

Analysis\r\nMarket share Analysis\r\nMajor Growth Strategy in the Postoperative Pain

-

Management Market\r\nCompetitive Benchmarking\r\nLeading Players in Terms of Number of Developments

-

in the Postoperative Pain Management Market\r\nKey

-

developments and growth strategies\r\n\r\nNew Product Launch/Service Deployment\r\nMerger

-

& Acquisitions\r\nJoint Ventures\r\n\r\n\r\nMajor Players Financial Matrix\r\n\r\nSales and Operating Income\r\nMajor

-

Players R&D Expenditure. 2023\r\n\r\n\r\n\r\n\r\n\r\n\r\nCompany Profiles\r\n\r\nZynerba Pharmaceuticals\r\n\r\nFinancial

-

Overview\r\nProducts Offered\r\nKey Developments\r\nSWOT

-

Analysis\r\nKey Strategies\r\n\r\n\r\nBaxter International\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nAbbVie\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nRoche\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nPacira Pharmaceuticals\r\n\r\nFinancial

-

Overview\r\nProducts Offered\r\nKey Developments\r\nSWOT

-

Analysis\r\nKey Strategies\r\n\r\n\r\nBoehringer Ingelheim\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nJohnson and Johnson \r\n\r\nFinancial

-

Overview\r\nProducts Offered\r\nKey Developments\r\nSWOT

-

Analysis\r\nKey Strategies\r\n\r\n\r\nStryker\r\n\r\nFinancial Overview\r\nProducts Offered\r\nKey

-

Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nTeleflex\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nHikma Pharmaceuticals\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nMylan\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nPurdue Pharma\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\nTornier\r\n\r\nFinancial Overview\r\nProducts

-

Offered\r\nKey Developments\r\nSWOT Analysis\r\nKey Strategies\r\n\r\n\r\n\r\n\r\n\r\n\r\nAppendix\r\n\r\nReferences\r\nRelated Reports\r\n\r\n\r\n\r\nLIST

-

Of tables

-

\r\n

-

\r\n\r\nLIST OF ASSUMPTIONS\r\nNorth

-

America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD Billions)\r\nNorth America Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nNorth

-

America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nNorth

-

America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nUS

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nUS Postoperative Pain Management Market

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nUS

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nCanada

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nCanada

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nCanada

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nEurope

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nEurope Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nEurope

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nGermany

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nGermany

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nGermany

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nUK

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nUK Postoperative Pain Management Market

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nUK

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nFrance

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nFrance

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nFrance

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nRussia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nRussia Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nRussia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nItaly

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nItaly

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nItaly

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nSpain

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nSpain Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nSpain

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nRest

-

of Europe Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY

-

PRODUCT TYPE, 2019-2035 (USD Billions)\r\nRest of Europe Postoperative

-

Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035

-

(USD Billions)\r\nRest of Europe Postoperative Pain Management Market SIZE

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nRest

-

of Europe Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY

-

END USER, 2019-2035 (USD Billions)\r\nRest of Europe Postoperative Pain

-

Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nAPAC

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nAPAC

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nAPAC

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nChina

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nChina Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nChina

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nIndia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nIndia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nIndia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nJapan

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nJapan Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nJapan

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nSouth

-

Korea Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD Billions)\r\nSouth Korea Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nSouth

-

Korea Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nSouth

-

Korea Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nMalaysia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nMalaysia Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nMalaysia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nThailand

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nThailand

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nThailand

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nIndonesia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nIndonesia Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nIndonesia

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nRest

-

of APAC Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD Billions)\r\nRest of APAC Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nRest

-

of APAC Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nRest

-

of APAC Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nSouth

-

America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nSouth America Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nSouth

-

America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END

-

USER, 2019-2035 (USD Billions)\r\nSouth America Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nBrazil

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nBrazil

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nBrazil

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nMexico

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nMexico Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nMexico

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nArgentina

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE,

-

SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nArgentina

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nArgentina

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nRest

-

of South America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST,

-

BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nRest of South America

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nRest

-

of South America Postoperative Pain Management Market SIZE ESTIMATES & FORECAST,

-

BY REGIONAL, 2019-2035 (USD Billions)\r\nMEA Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nMEA

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nMEA Postoperative Pain Management Market

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nMEA

-

Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END USER,

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nGCC

-

Countries Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY

-

PRODUCT TYPE, 2019-2035 (USD Billions)\r\nGCC Countries Postoperative Pain

-

Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035

-

(USD Billions)\r\nGCC Countries Postoperative Pain Management Market SIZE

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nGCC

-

Countries Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY

-

END USER, 2019-2035 (USD Billions)\r\nGCC Countries Postoperative Pain

-

Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nSouth

-

Africa Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY PRODUCT

-

TYPE, 2019-2035 (USD Billions)\r\nSouth Africa Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION ROUTE, 2019-2035 (USD Billions)\r\nSouth

-

Africa Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY APPLICATION,

-

Market SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD Billions)\r\nSouth

-

Africa Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY REGIONAL,

-

SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2035 (USD Billions)\r\nRest

-

of MEA Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY ADMINISTRATION

-

ROUTE, 2019-2035 (USD Billions)\r\nRest of MEA Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)\r\nRest

-

of MEA Postoperative Pain Management Market SIZE ESTIMATES & FORECAST, BY END

-

USER, 2019-2035 (USD Billions)\r\nRest of MEA Postoperative Pain Management

-

Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)\r\nPRODUCT

-

LAUNCH/PRODUCT DEVELOPMENT/APPROVAL\r\nACQUISITION/PARTNERSHIP\r\n\r\nLIST

-

Of figures

-

\r\n

-

\r\n\r\nMARKET

-

SYNOPSIS\r\nNORTH AMERICA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS\r\nUS POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nUS POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nUS POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY APPLICATION\r\nUS POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY END USER\r\nUS

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nCANADA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nCANADA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY ADMINISTRATION ROUTE\r\nCANADA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nCANADA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nCANADA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY REGIONAL\r\nEUROPE POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS\r\nGERMANY POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nGERMANY POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION

-

ROUTE\r\nGERMANY POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY APPLICATION\r\nGERMANY

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nGERMANY POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nUK POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE\r\nUK POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nUK POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nUK POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY END USER\r\nUK POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY REGIONAL\r\nFRANCE POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nFRANCE POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION

-

ROUTE\r\nFRANCE POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY APPLICATION\r\nFRANCE

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nFRANCE POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nRUSSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE\r\nRUSSIA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nRUSSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nRUSSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY END USER\r\nRUSSIA POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nITALY

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nITALY POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION

-

ROUTE\r\nITALY POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY APPLICATION\r\nITALY

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nITALY POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nSPAIN POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE\r\nSPAIN POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nSPAIN POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nSPAIN POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY END USER\r\nSPAIN POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nREST

-

OF EUROPE POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nREST OF EUROPE POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY ADMINISTRATION ROUTE\r\nREST

-

OF EUROPE POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nREST OF EUROPE POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY END USER\r\nREST OF EUROPE POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nAPAC

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS\r\nCHINA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nCHINA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION

-

ROUTE\r\nCHINA POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY APPLICATION\r\nCHINA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nCHINA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nINDIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY PRODUCT TYPE\r\nINDIA POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nINDIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nINDIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY END USER\r\nINDIA POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nJAPAN

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nJAPAN POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION

-

ROUTE\r\nJAPAN POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY APPLICATION\r\nJAPAN

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nJAPAN POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nSOUTH KOREA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY PRODUCT TYPE\r\nSOUTH KOREA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nSOUTH KOREA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY APPLICATION\r\nSOUTH KOREA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nSOUTH

-

KOREA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nMALAYSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nMALAYSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY ADMINISTRATION ROUTE\r\nMALAYSIA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nMALAYSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nMALAYSIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY REGIONAL\r\nTHAILAND POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nTHAILAND

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nTHAILAND POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY APPLICATION\r\nTHAILAND POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nTHAILAND

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nINDONESIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nINDONESIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY ADMINISTRATION ROUTE\r\nINDONESIA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nINDONESIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nINDONESIA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY REGIONAL\r\nREST OF APAC POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nREST OF APAC POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION

-

ROUTE\r\nREST OF APAC POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nREST

-

OF APAC POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nREST OF APAC POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nSOUTH AMERICA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS\r\nBRAZIL POSTOPERATIVE PAIN MANAGEMENT

-

MARKET ANALYSIS BY PRODUCT TYPE\r\nBRAZIL

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nBRAZIL POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY APPLICATION\r\nBRAZIL POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY END USER\r\nBRAZIL

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nMEXICO POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nMEXICO POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY ADMINISTRATION ROUTE\r\nMEXICO POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY APPLICATION\r\nMEXICO POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nMEXICO POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY REGIONAL\r\nARGENTINA POSTOPERATIVE PAIN

-

MANAGEMENT MARKET ANALYSIS BY PRODUCT TYPE\r\nARGENTINA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nARGENTINA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS

-

BY APPLICATION\r\nARGENTINA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nARGENTINA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nREST OF SOUTH AMERICA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY

-

PRODUCT TYPE\r\nREST OF SOUTH AMERICA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nREST OF SOUTH AMERICA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY

-

APPLICATION\r\nREST OF SOUTH AMERICA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nREST

-

OF SOUTH AMERICA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nMEA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS\r\nGCC COUNTRIES POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY PRODUCT TYPE\r\nGCC COUNTRIES

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nGCC COUNTRIES POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY APPLICATION\r\nGCC COUNTRIES

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nGCC COUNTRIES POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nSOUTH AFRICA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY PRODUCT TYPE\r\nSOUTH AFRICA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nSOUTH AFRICA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY APPLICATION\r\nSOUTH AFRICA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nSOUTH AFRICA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nREST OF MEA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY PRODUCT TYPE\r\nREST OF MEA

-

POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY ADMINISTRATION ROUTE\r\nREST OF MEA POSTOPERATIVE PAIN MANAGEMENT MARKET

-

ANALYSIS BY APPLICATION\r\nREST OF MEA POSTOPERATIVE

-

PAIN MANAGEMENT MARKET ANALYSIS BY END USER\r\nREST

-

OF MEA POSTOPERATIVE PAIN MANAGEMENT MARKET ANALYSIS BY REGIONAL\r\nKEY BUYING CRITERIA OF POSTOPERATIVE PAIN MANAGEMENT MARKET\r\nRESEARCH PROCESS OF MRFR\r\nDRO ANALYSIS OF POSTOPERATIVE PAIN MANAGEMENT MARKET\r\nDRIVERS IMPACT ANALYSIS: POSTOPERATIVE PAIN MANAGEMENT MARKET\r\nRESTRAINTS IMPACT ANALYSIS: POSTOPERATIVE PAIN MANAGEMENT

-

MARKET\r\nSUPPLY / VALUE CHAIN: POSTOPERATIVE

-

PAIN MANAGEMENT MARKET\r\nPOSTOPERATIVE

-

PAIN MANAGEMENT MARKET, BY PRODUCT TYPE, 2025 (% SHARE)\r\nPOSTOPERATIVE PAIN MANAGEMENT MARKET, BY PRODUCT TYPE, 2019 TO 2035 (USD

-

Billions)\r\nPOSTOPERATIVE PAIN MANAGEMENT

-

MARKET, BY ADMINISTRATION ROUTE, 2025 (% SHARE)\r\nPOSTOPERATIVE PAIN MANAGEMENT MARKET, BY ADMINISTRATION ROUTE, 2019 TO

-

MANAGEMENT MARKET, BY APPLICATION, 2025 (% SHARE)\r\nPOSTOPERATIVE PAIN MANAGEMENT MARKET, BY APPLICATION, 2019 TO 2035 (USD

-

Billions)\r\nPOSTOPERATIVE PAIN MANAGEMENT

-

MARKET, BY END USER, 2025 (% SHARE)\r\nPOSTOPERATIVE

-

PAIN MANAGEMENT MARKET, BY END USER, 2019 TO 2035 (USD Billions)\r\nPOSTOPERATIVE PAIN MANAGEMENT MARKET, BY REGIONAL, 2025 (% SHARE)\r\nPOSTOPERATIVE PAIN MANAGEMENT MARKET, BY REGIONAL,

-

OF MAJOR COMPETITORS\r\n

Leave a Comment