Market Share

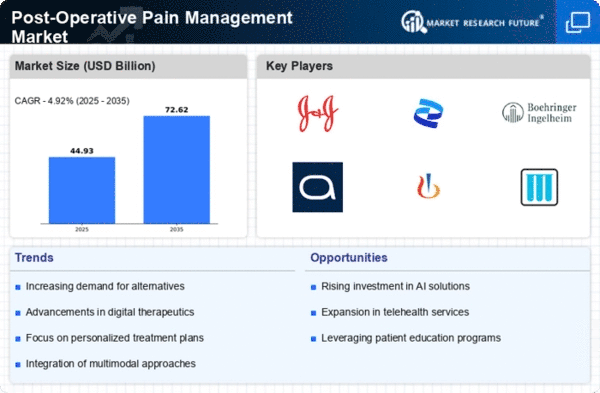

Post-Operative Pain Management Market Share Analysis

The Post-Operative Pain Management market is vital to the healthcare sector, relieving pain and guaranteeing patient comfort after surgery. To be competitive and accommodate healthcare providers' and patients' changing requirements, organizations use market share positioning strategies.

Product innovation and differentiation are common in this area. Companies spend a lot of money on R&D to develop new painkillers, tailored medication delivery methods, and non-pharmacological treatments. These firms may attract healthcare professionals and institutions seeking innovative post-operative pain treatment options by delivering novel and effective goods.

Market share positioning also depends on strategic alliances and cooperation. Companies regularly partner with healthcare institutions, research groups, and others to expand their markets. Comprehensive pain treatment programs including medications, medical devices, and supportive services may be created through collaboration. Such integrated solutions might distinguish a firm as a comprehensive provider for healthcare providers' diversified demands.

Companies also use market penetration to strengthen their Post-Operative Pain Management position. This entails improving market uptake of existing items. Companies may focus on growing distribution networks, building strong connections with healthcare practitioners, and teaching doctors about product advantages. This strategy maximizes present products to gain market share.

Geographic growth is crucial to Post-Operative Pain Management market share positioning. Companies pursue new regions or nations where superior pain management solutions are in demand. Companies may customize their strategy to regional issues and preferences by studying regional healthcare environments. This increases their consumer base and market share.

In this competitive market, cost leadership works too. To compete on price, companies may optimize production processes, source cheap raw materials, and manage their supply chains. This technique may appeal to healthcare professionals seeking cost-effective post-operative pain treatment.

Leave a Comment