E-commerce Growth

The rapid growth of e-commerce is significantly impacting the Port and Material Handling Equipment Vehicle Market. As online shopping continues to gain traction, the demand for efficient logistics and material handling solutions is escalating. In 2025, it is estimated that e-commerce sales will account for a substantial portion of total retail sales, leading to increased pressure on ports to handle higher volumes of goods. This surge in demand necessitates the adoption of advanced material handling equipment to ensure timely and efficient delivery. Consequently, manufacturers are focusing on developing versatile and high-capacity vehicles that can accommodate the unique challenges posed by e-commerce logistics, thereby driving growth within the Port and Material Handling Equipment Vehicle Market.

Increased Trade Activities

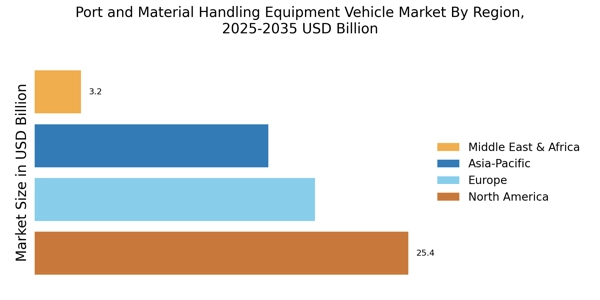

The Port and Material Handling Equipment Vehicle Market is experiencing a surge in demand due to heightened trade activities across various sectors. As economies expand, the volume of goods transported through ports increases, necessitating efficient material handling solutions. In 2025, it is projected that global trade will reach unprecedented levels, with container throughput expected to grow by approximately 4.5% annually. This growth drives the need for advanced port vehicles and equipment, as companies seek to optimize their operations and reduce turnaround times. Consequently, manufacturers are focusing on developing innovative solutions that enhance productivity and efficiency in the handling of cargo, thereby propelling the Port and Material Handling Equipment Vehicle Market forward.

Sustainability Initiatives

Sustainability initiatives are becoming increasingly prominent within the Port and Material Handling Equipment Vehicle Market. As environmental concerns rise, companies are prioritizing eco-friendly practices and equipment. The shift towards electric and hybrid vehicles is indicative of this trend, as organizations aim to reduce their carbon footprint and comply with environmental regulations. In 2025, the market for sustainable material handling equipment is projected to grow, driven by the need for greener solutions. This focus on sustainability not only enhances corporate responsibility but also aligns with consumer preferences for environmentally friendly products. Consequently, manufacturers are investing in research and development to create innovative, sustainable equipment that meets the evolving demands of the Port and Material Handling Equipment Vehicle Market.

Technological Advancements

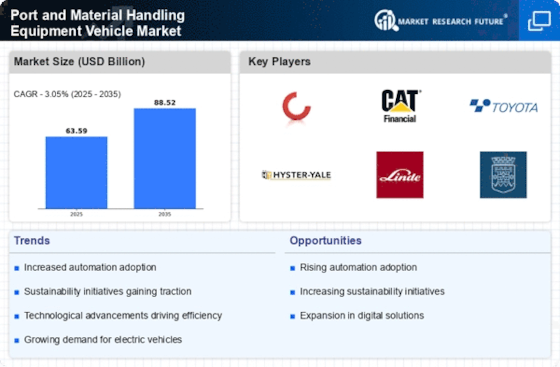

Technological advancements play a pivotal role in shaping the Port and Material Handling Equipment Vehicle Market. The integration of cutting-edge technologies such as automation, artificial intelligence, and the Internet of Things is revolutionizing material handling processes. For instance, automated guided vehicles (AGVs) and smart cranes are increasingly being adopted to streamline operations and minimize human error. In 2025, the market for automated material handling equipment is expected to grow significantly, with a compound annual growth rate of around 10%. This trend indicates a shift towards more efficient and reliable equipment, which is essential for meeting the demands of modern logistics and supply chain management within the Port and Material Handling Equipment Vehicle Market.

Regulatory Compliance and Safety Standards

The Port and Material Handling Equipment Vehicle Market is influenced by stringent regulatory compliance and safety standards. Governments and international organizations are implementing regulations aimed at enhancing safety and environmental sustainability in port operations. Compliance with these regulations often necessitates the adoption of advanced material handling equipment that meets specific safety criteria. In 2025, it is anticipated that the demand for equipment adhering to these standards will increase, as companies strive to avoid penalties and enhance their operational safety. This trend not only drives innovation in equipment design but also fosters a competitive landscape within the Port and Material Handling Equipment Vehicle Market, as manufacturers seek to offer compliant and safe solutions.