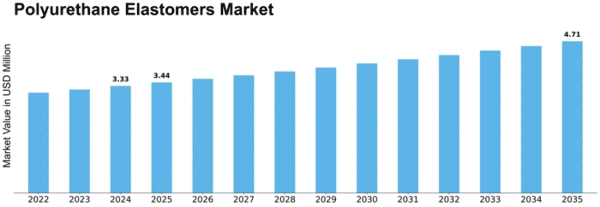

Polyurethane Elastomers Size

Polyurethane Elastomers Market Growth Projections and Opportunities

The Polyurethane Elastomers Market is influenced by various factors that contribute to its dynamics and growth. Here's a simplified breakdown of these factors in a paragraph-based, pointer format:

Versatility and Wide Range of Applications: One of the primary drivers of the polyurethane elastomers market is the material's versatility and its ability to cater to a wide range of applications across various industries. Polyurethane elastomers exhibit unique properties such as high resilience, flexibility, abrasion resistance, and chemical resistance, making them suitable for diverse applications including automotive, construction, footwear, industrial, and healthcare. The versatility of polyurethane elastomers allows for customization and formulation adjustments to meet specific performance requirements and application needs, driving their adoption in different end-use industries.

Automotive Industry Demand: The automotive industry is a significant consumer of polyurethane elastomers, where they are used in applications such as automotive seating, interior components, suspension systems, gaskets, seals, and tires. Polyurethane elastomers offer advantages such as lightweight, durability, noise reduction, and vibration damping, improving vehicle performance, comfort, and safety. The demand for polyurethane elastomers in the automotive industry is driven by the need for lightweight materials that contribute to fuel efficiency, as well as the requirement for high-performance materials that meet stringent automotive standards and specifications.

Construction Sector Growth: The construction sector is another key market for polyurethane elastomers, where they are used in applications such as sealants, adhesives, coatings, insulation, and structural components. Polyurethane elastomers provide excellent adhesion, weatherability, thermal insulation, and moisture resistance, enhancing the durability, energy efficiency, and sustainability of construction materials and structures. The demand for polyurethane elastomers in the construction sector is driven by urbanization, infrastructure development, and green building initiatives that prioritize energy-efficient and environmentally friendly construction materials.

Footwear Industry Applications: Polyurethane elastomers are extensively used in the footwear industry for the production of shoe soles, midsoles, outsoles, and other footwear components. Polyurethane elastomers offer advantages such as lightweight, cushioning, shock absorption, and flexibility, providing comfort and performance benefits to footwear products. The demand for polyurethane elastomers in the footwear industry is driven by consumer preferences for comfortable and durable footwear, as well as the need for high-performance materials that meet industry standards for footwear manufacturing.

Healthcare and Medical Device Sector: The healthcare and medical device sector is a growing market for polyurethane elastomers, where they are used in applications such as medical tubing, catheters, wound dressings, prosthetics, orthopedic implants, and medical device components. Polyurethane elastomers offer biocompatibility, sterilizability, and mechanical properties that make them suitable for medical and healthcare applications. The demand for polyurethane elastomers in the healthcare sector is driven by aging populations, advancements in medical technology, and the increasing prevalence of chronic diseases that require medical devices and implants.

Raw Material Availability and Pricing: The availability and pricing of raw materials such as isocyanates, polyols, and additives impact market dynamics in the polyurethane elastomers market. Fluctuations in raw material prices, supply chain disruptions, and geopolitical factors can influence production costs and pricing strategies, affecting market competitiveness and profitability for polyurethane elastomers manufacturers and suppliers.

Technological Advancements and Product Innovation: Technological advancements in polyurethane chemistry, formulation development, and manufacturing processes drive innovation in the polyurethane elastomers market. Manufacturers invest in research and development to develop advanced polyurethane elastomers with improved performance attributes such as durability, resilience, flexibility, and sustainability. Innovative polyurethane elastomer technologies such as thermoplastic polyurethane (TPU), thermoplastic polyurethane elastomers (TPUE), and bio-based polyurethane elastomers enable the development of high-performance materials for diverse applications.

Regulatory Compliance and Standards: Regulatory compliance and industry standards governing polyurethane elastomers influence market dynamics in terms of product quality, safety, and performance. Manufacturers and suppliers need to adhere to regulatory requirements and industry standards for polyurethane elastomers to ensure product compliance, reliability, and consumer confidence. Compliance with regulations such as REACH in Europe and regulatory standards set by organizations like ASTM International and ISO is essential for polyurethane elastomers manufacturers to access global markets and meet customer requirements.

Market Competition and Industry Consolidation: The polyurethane elastomers market is characterized by intense competition among key players, driving innovation, pricing strategies, and market consolidation efforts. Established manufacturers leverage mergers, acquisitions, and strategic partnerships to strengthen their market presence, expand product portfolios, and enhance competitive positioning. Market players differentiate their polyurethane elastomers based on performance attributes, formulation expertise, technical support, and customer service to gain a competitive edge in the market.

Global Economic Trends and Market Volatility: Global economic trends, market volatility, currency fluctuations, and geopolitical factors impact market dynamics and investment decisions in the polyurethane elastomers industry. Market players need to monitor and adapt to changing economic conditions and market uncertainties to mitigate risks and capitalize on emerging opportunities in the polyurethane elastomers market.

Leave a Comment