Top Industry Leaders in the Polyurethane Additive Market

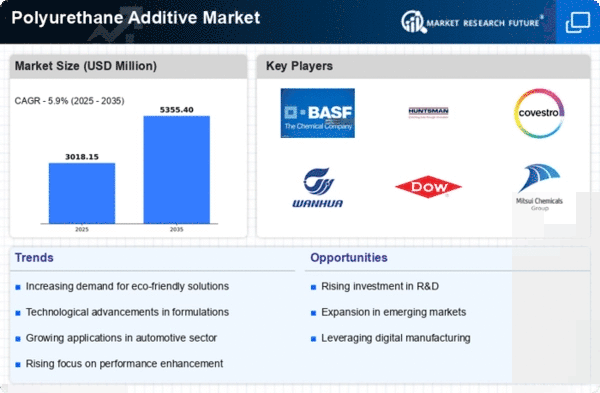

The polyurethane additives market, valued at $3.5 billion in 2023, is a dynamic arena where innovation and strategic maneuvering reign supreme. To navigate this complex landscape, let's delve into the competitive strategies driving market share, industry news, and recent developments from the past six months.

The polyurethane additives market, valued at $3.5 billion in 2023, is a dynamic arena where innovation and strategic maneuvering reign supreme. To navigate this complex landscape, let's delve into the competitive strategies driving market share, industry news, and recent developments from the past six months.

Market Segmentation and Strategies:

-

Product Differentiation: Companies like BASF, Lanxess, and Dow Chemical invest heavily in R&D to develop niche additives with enhanced properties like biodegradability, flame resistance, and improved processing efficiency. Luju International Group's recent launch of eco-friendly aromatic amine blowing agents exemplifies this trend. -

Vertical Integration: Backward integration into feedstock production is gaining traction. Huntsman Corporation's acquisition of TDI producer Nresposta in 2023 reflects this strategy, ensuring control over critical raw materials and cost competitiveness. -

Geographic Expansion: Emerging markets in Asia-Pacific present lucrative opportunities. Huntsman's expansion in China through a joint venture with Zhejiang Yeming demonstrates this focus. -

M&A Activity: Consolidation through mergers and acquisitions is shaping the market. Covestro's acquisition of Dow's polyurethane additives business in 2021 is a prime example, strengthening Covestro's position in the coatings and adhesives segment.

Factors Influencing Market Share:

-

End-Use Industries: Growing demand for polyurethane products in construction, furniture, automotive, and packaging industries directly impacts additive consumption. The booming Asian construction market, for instance, benefits regional additive players. -

Regulatory Landscape: Stringent regulations on flame retardants and volatile organic compounds (VOCs) are driving demand for safer and eco-friendly alternatives. Evonik Industries' recent launch of non-halogenated flame retardants exemplifies this response. -

Raw Material Prices: Fluctuations in crude oil prices directly affect feedstock costs for polyurethane additives. Recent oil price volatility has led to temporary market fluctuations. -

Sustainability: The increasing focus on sustainable practices is pushing for bio-based and recyclable additives. Covestro's development of bio-based polyols is a step in this direction.

Key Companies in the Polyurethane Additives market include

- BASF SE (Germany)

- Covestro AG (Germany)

- Evonik Industries AG (Germany)

- Kao Corporation (Japan)

- Huntsman International LLC (US)

- Tosoh Corporation (Japan)

- The Dow Chemical Company (US

- Momentive (US)

- Air Products and Chemicals Inc. (US)

- Suzhou Xiangyuan Special Fine Chemical Co. Ltd (China)

Recent Developments:

-

Focus on Innovation: Companies are actively investing in R&D for novel additives with improved performance and sustainability credentials. -

Sustainability Gaining Traction: Eco-friendly alternatives in blowing agents, flame retardants, and bio-based polyols are witnessing increased demand. -

Supply Chain Challenges: Geopolitical issues and pandemic disruptions pose temporary hurdles for raw material sourcing and production. -

Regulatory Landscape Evolving: New regulations on specific additives necessitate adaptations and product development efforts. -

Regional Dynamics: Asia-Pacific remains a key growth market, attracting investments and expansions from major players.