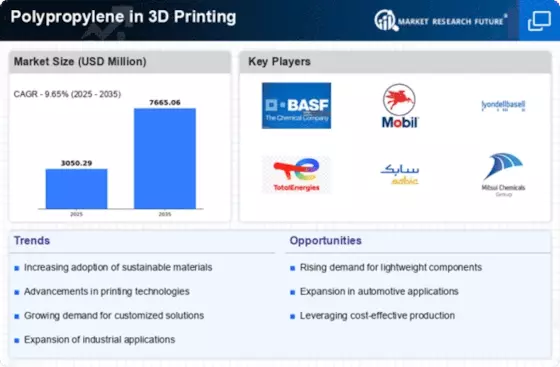

The Polypropylene In 3D Printing Market is currently characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Key players such as BASF SE (DE), ExxonMobil Chemical (US), and LyondellBasell Industries (US) are actively shaping the market through their distinct operational focuses. BASF SE (DE) emphasizes innovation in material development, particularly in enhancing the properties of polypropylene for 3D printing applications. ExxonMobil Chemical (US) is strategically investing in sustainable practices, aiming to reduce the environmental impact of its production processes. Meanwhile, LyondellBasell Industries (US) is pursuing regional expansion, particularly in emerging markets, to capitalize on the growing demand for 3D printing materials. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and sustainability.

In terms of business tactics, companies are localizing manufacturing to enhance supply chain efficiency and reduce lead times. The market structure appears moderately fragmented, with several key players exerting influence while also allowing for niche entrants. This fragmentation fosters a competitive atmosphere where innovation and customer-centric solutions are paramount. The collective influence of these major players is significant, as they set industry standards and drive market trends through their strategic initiatives.

In January 2026, BASF SE (DE) announced a collaboration with a leading 3D printing technology firm to develop a new line of polypropylene-based filaments. This partnership is expected to enhance the performance characteristics of their products, making them more suitable for industrial applications. The strategic importance of this collaboration lies in its potential to position BASF as a leader in high-performance materials, catering to the evolving needs of the 3D printing sector.

In December 2025, ExxonMobil Chemical (US) unveiled a new sustainability initiative aimed at reducing carbon emissions in its polypropylene production processes. This initiative includes the implementation of advanced technologies that could lower emissions by up to 30% over the next five years. The significance of this move is profound, as it aligns with global sustainability goals and positions ExxonMobil as a forward-thinking player in the market, appealing to environmentally conscious consumers and businesses alike.

In November 2025, LyondellBasell Industries (US) expanded its production capacity for polypropylene in response to increasing demand from the 3D printing sector. This expansion is expected to enhance their market share and improve supply chain reliability. The strategic importance of this capacity increase is notable, as it not only meets current demand but also prepares the company for future growth opportunities in the rapidly evolving 3D printing landscape.

As of February 2026, current competitive trends in the Polypropylene In 3D Printing Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly vital, as companies seek to leverage complementary strengths to enhance their market positions. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift underscores the importance of adaptability and forward-thinking strategies in navigating the complexities of the market.