Market Trends

Key Emerging Trends in the Polypropylene Compounds Market

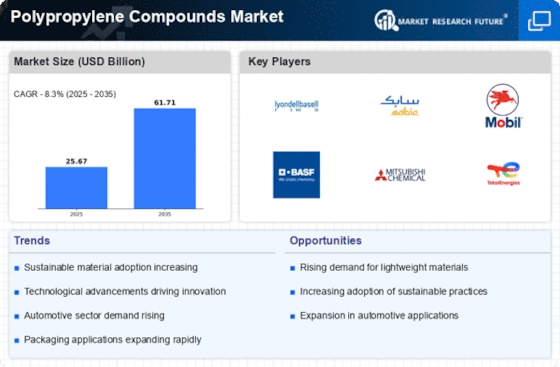

The Polypropylene compounds Market is experiencing fantastic tendencies pushed by way of factors, which include technological improvements, sustainability issues, and various packages across industries. There is a fast boom in the use of polypropylene compounds within the automotive industry. The materials are desired for their lightweight houses, excessive effect resistance, and versatility. Polypropylene compounds find programs in various car components, including indoor components, outdoor trims, and beneath-the-hood components. Lightweighting has emerged as a key fashion in the automobile and transportation sectors to decorate fuel efficiency. Polypropylene compounds contribute to this trend by presenting a lightweight alternative to standard materials without compromising performance. The demand for fuel-green automobiles is riding the adoption of polypropylene compounds in car design. Sustainability is a distinguished fashion inside the polypropylene compounds market. Manufacturers are placing a robust emphasis on developing sustainable formulations, including recycled and bio-primarily based polypropylene compounds. The focus on recyclability aligns with global tasks to lessen plastic waste and sell a round economic system. Advancements in compound formulations are riding innovation in the polypropylene compounds market. Manufacturers are investing in research and improvement to create specialized formulations with superior houses, which include flame retardancy, UV resistance, and progressed mechanical electricity, catering to particular software requirements. There is a super shift towards the usage of glass fiber-bolstered polypropylene compounds. These compounds provide extended electricity, stiffness, and dimensional stability, making them suitable for packages requiring better mechanical properties. Glass fiber-bolstered polypropylene compounds find use in car and industrial packages. Polypropylene compounds are located in extended integration inside the production of medical gadgets and systems. The materials are chosen for their biocompatibility, chemical resistance, and simplicity of sterilization. Polypropylene compounds make a contribution to the improvement of clinical products with stringent performance and regulatory necessities. The trend toward custom-designed compounds is gaining momentum. Manufacturers are operating intently with give-up-users to expand polypropylene compounds tailored to precise industry desires. Customization allows for the introduction of compounds with optimized traits, together with shade, texture, and functional homes. Electrically conductive polypropylene compounds are rising as a specialized class. These compounds discover applications in the electronics and electric industries, in which static dissipation and electrical conductivity are vital. The improvement of electrically conductive polypropylene compounds helps the evolving desires of digital packages. Polypropylene compounds play a sizeable role in the construction area. The materials are utilized within the production of pipes, fittings, insulation materials, and other construction components. Polypropylene compounds offer durability, resistance to chemicals, and ease of setup in construction applications.

Leave a Comment