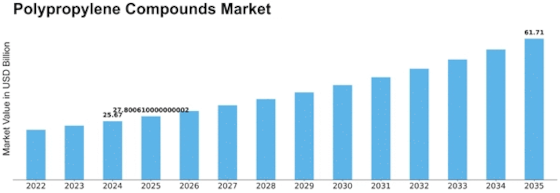

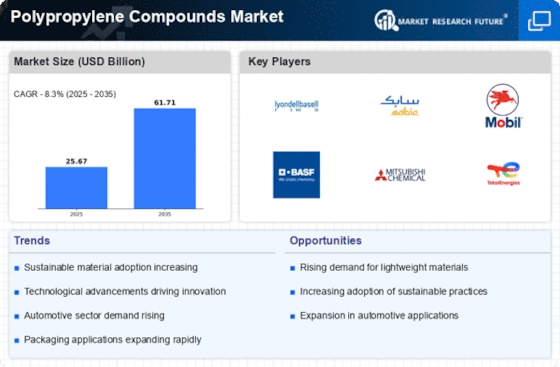

Polypropylene Compounds Size

Polypropylene Compounds Market Growth Projections and Opportunities

The polypropylene compounds Market is famous for the dynamic interaction of factors that collectively form its landscape, influencing demand, pricing, and average boom throughout diverse applications. The demand for polypropylene compounds is intricately connected to stop-use packages in industries including car, packaging, production, and consumer items. The car industry, a chief customer of polypropylene compounds, extensively influences marketplace dynamics. The packaging industry, driven by changing customer preferences and sustainability goals, influences the polypropylene compounds marketplace. As packaging designs evolve and environmental issues come to the leading edge, the demand for innovative polypropylene compounds grows. The creation enterprise, with its diverse applications ranging from pipes and fittings to insulation materials, drives the demand for polypropylene compounds. Consumer items, consisting of family appliances, furniture, and electronic additives, contribute to the call for polypropylene compounds. Increasing emphasis on recycling and sustainability impacts the polypropylene compounds marketplace. Manufacturers and stop-users are searching for environmentally pleasant alternatives, and innovations in recyclable and recycled polypropylene compounds affect market possibilities. Ongoing advancements in compound formulations, including the development of excessive-performance components and fillers, affect marketplace dynamics. The regulatory surroundings, encompassing safety requirements and compliance requirements, shape the polypropylene compounds marketplace. Adherence to rules and certifications affects material specifications and market acceptance. Global alternate dynamics, inclusive of raw cloth availability, price lists, and supply chain disruptions, impact the polypropylene compounds market. Fluctuations in the prices and availability of uncooked materials, in particular polypropylene resin, without delay affect the price shape of polypropylene compounds. Market members carefully monitor and reply to changes in uncooked cloth costs to preserve competitiveness. Evolving purchaser preferences and way of life modifications have an impact on the styles of products and substances in call for. Polypropylene compounds, regarded for their versatility and price effectiveness, are regularly selected in response to customer possibilities for durable, lightweight, and aesthetically desirable products.

Leave a Comment