Top Industry Leaders in the Polypropylene Catalyst Market

Polypropylene (PP), the ubiquitous workhorse of the plastics world, owes its remarkable versatility and abundance to a group of unsung heroes - polypropylene catalysts. These intricate chemical concoctions dictate the polymer's structure, influencing its strength, flexibility, and suitability for applications ranging from textiles and packaging to automotive components and medical devices. Navigating the dynamic landscape of the polypropylene catalyst market is crucial for both established players and newcomers hoping to capitalize on the polymer's ever-expanding reach.

Polypropylene (PP), the ubiquitous workhorse of the plastics world, owes its remarkable versatility and abundance to a group of unsung heroes - polypropylene catalysts. These intricate chemical concoctions dictate the polymer's structure, influencing its strength, flexibility, and suitability for applications ranging from textiles and packaging to automotive components and medical devices. Navigating the dynamic landscape of the polypropylene catalyst market is crucial for both established players and newcomers hoping to capitalize on the polymer's ever-expanding reach.

Strategic Maneuvers for Market Dominance:

Leading players like Ziegler-Natta GmbH, W.R. Grace & Co., and Dow Chemical Company employ a range of strategies to maintain their hold on the market:

-

Product diversification: Offering a vast portfolio of catalysts catering to specific PP grades and application requirements. This includes Ziegler-Natta, metallocene, and supported catalysts with varying activity, selectivity, and stability. -

Technological innovation: Investing heavily in R&D to develop next-generation catalysts with improved performance, higher productivity, and enhanced process efficiency. This includes exploring sustainable alternatives like bio-based catalysts and greener production processes. -

Regional expansion: Targeting high-growth markets like Asia Pacific and Latin America by establishing local production facilities and tailoring offerings to regional feedstock variations and regulatory requirements. -

Vertical integration: Gaining control over the supply chain by acquiring raw material suppliers or expanding into downstream applications like PP production. -

Strategic partnerships: Collaborating with research institutions, universities, and technology startups to accelerate innovation and access cutting-edge knowledge and technology.

Factors Dictating Market Share:

Success in this competitive market hinges on several key factors:

-

Catalyst performance: Delivering catalysts with consistent activity, selectivity, and compatibility with diverse feedstocks, ensuring high-quality PP production and meeting industry standards. -

Cost competitiveness: Balancing high performance with affordability, especially in price-sensitive sectors like packaging and disposable goods. -

Sustainability focus: Demonstrating a commitment to eco-friendly catalysts with reduced environmental impact through bio-based materials, low-VOC formulations, and energy-efficient production processes. -

Regulatory compliance: Ensuring adherence to stringent regulations regarding catalyst safety, environmental impact, and potential migration into finished products. -

Technical expertise and customer service: Building strong relationships with clients through responsive technical support, customized solutions, and efficient after-sales support.

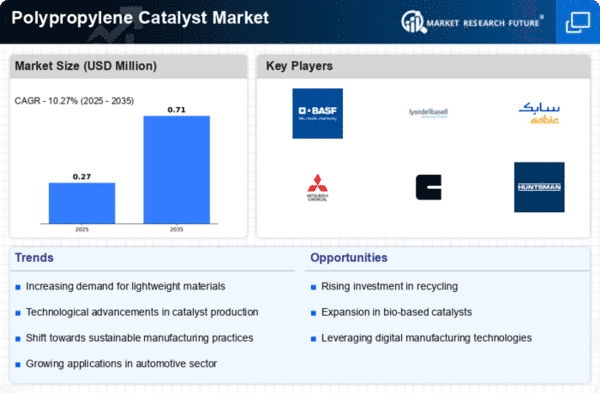

Key players

- Lyondell Basell Industries Holdings BV

- Clariant

- Mitsui Chemicals Inc

- China petrochemical corporation

- Japan polypropylene corporation

- Mitsubishi chemical corporation

- Reliance industries limited

- SABIC

- Univation Technologies LLC

- R.Grace and Co conn

Recent Developments:

-

October 2023: Advancements in artificial intelligence and machine learning allow for better catalyst design and optimization, leading to improved performance and efficiency. -

November 2023: Growing awareness of the need for circular economy solutions leads to the development of catalysts for PP recycling, enabling closed-loop production systems. -

December 2023: The increasing focus on lightweighting in automotive applications fuels demand for high-performance PP catalysts capable of producing stronger and lighter materials.