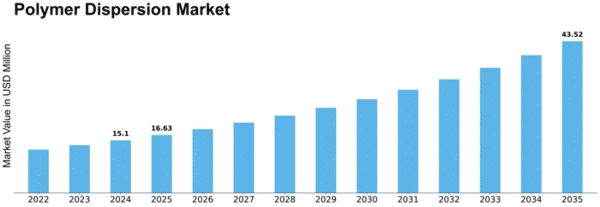

Polymer Dispersion Size

Polymer Dispersion Market Growth Projections and Opportunities

The polymer dispersion market is influenced by several key factors that shape its dynamics and growth prospects. One significant driver of this market is the increasing demand for eco-friendly and sustainable coatings and adhesives across various industries. As awareness of environmental issues grows, there is a rising preference for water-based polymer dispersions over solvent-based alternatives due to their lower VOC (volatile organic compound) emissions and reduced environmental impact. This shift towards environmentally friendly solutions is driving the adoption of polymer dispersions in applications such as paints, coatings, adhesives, and sealants.

Technological advancements in polymer dispersion formulations and manufacturing processes also play a crucial role in driving market growth. Manufacturers are continually innovating to develop polymer dispersions with improved properties such as enhanced durability, adhesion, and weather resistance. Additionally, advancements in dispersion technology enable the production of customized polymer dispersions tailored to meet specific performance requirements of end-users, thereby expanding the market potential across various industries.

Moreover, regulatory standards and government initiatives aimed at reducing emissions and promoting sustainable practices are driving the adoption of polymer dispersions. Regulatory bodies worldwide are imposing stricter regulations on the use of solvent-based coatings and adhesives, thereby encouraging the transition towards water-based alternatives. Compliance with these regulations is incentivizing industries to invest in eco-friendly solutions like polymer dispersions, driving market growth and expansion.

The growing construction and automotive industries are also significant drivers of the polymer dispersion market. Polymer dispersions find extensive applications in construction materials such as paints, coatings, sealants, and adhesives due to their excellent adhesion, durability, and weather resistance properties. Similarly, in the automotive industry, polymer dispersions are used in coatings and adhesives for vehicle exteriors and interiors, contributing to the market's growth. As urbanization and infrastructure development continue to drive demand for construction materials and automotive products, the demand for polymer dispersions is expected to witness steady growth.

Furthermore, the competitive landscape of the polymer dispersion market influences its dynamics and growth trajectory. With numerous players operating in the market, competition is intense in terms of product innovation, quality, and pricing. Manufacturers are investing in research and development to introduce novel polymer dispersion formulations that offer superior performance and address evolving customer needs. Strategic collaborations, partnerships, and acquisitions are also common strategies adopted by companies to expand their market presence and gain a competitive edge.

Economic factors such as GDP growth, industrial output, and consumer spending patterns also impact the polymer dispersion market. Economic growth stimulates construction activities, infrastructure development, and automotive production, thereby driving the demand for polymer dispersions in related applications. Moreover, rising disposable incomes and changing lifestyles drive the demand for durable and aesthetically pleasing coatings and adhesives, further fueling market growth.

Leave a Comment