Rising Demand for Sustainable Textiles

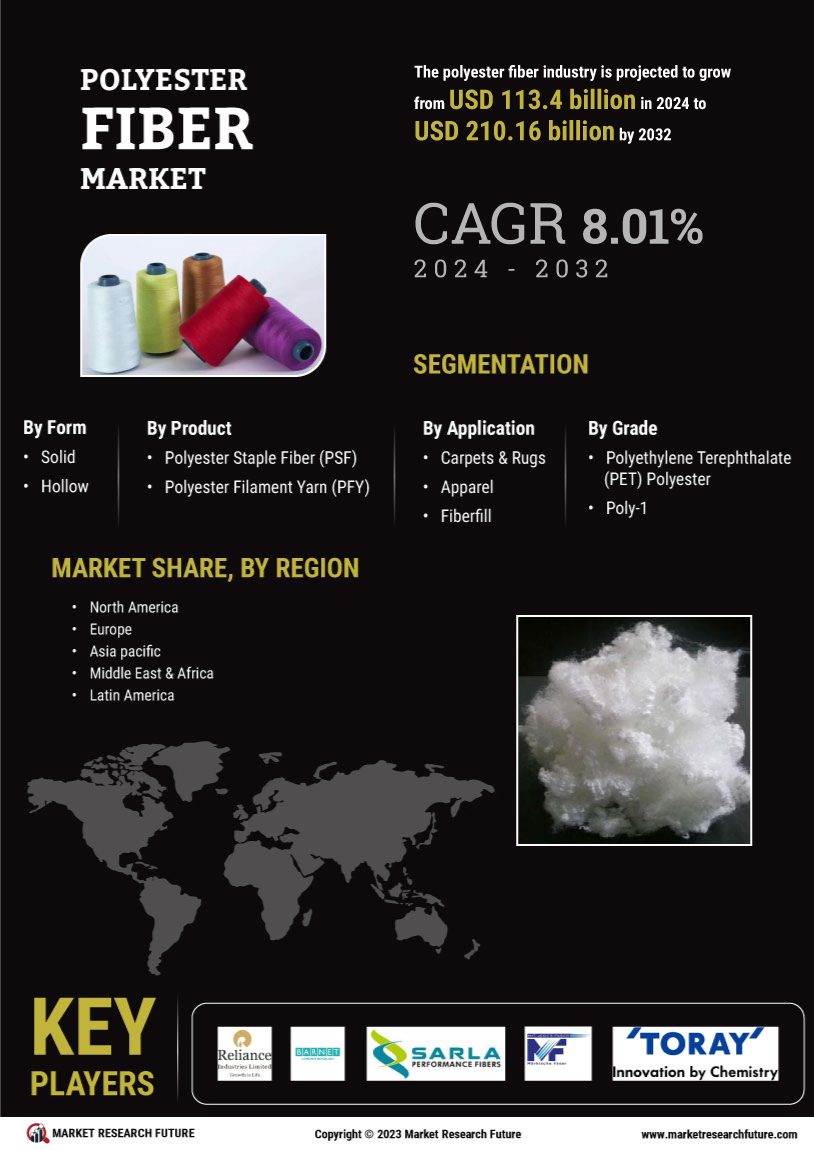

The increasing consumer awareness regarding environmental issues appears to drive the demand for sustainable textiles, including those made from polyester fibers. As consumers become more conscious of their purchasing decisions, the Polyester Fiber Market is witnessing a shift towards eco-friendly products. This trend is further supported by the growing number of brands committing to sustainability, which has led to a projected increase in the market size. Reports indicate that the demand for recycled polyester is expected to rise significantly, potentially reaching a market value of several billion dollars by 2027. This shift not only reflects changing consumer preferences but also encourages manufacturers to innovate and adopt sustainable practices, thereby enhancing the overall growth of the Polyester Fiber Market.

Growth of the Fashion and Apparel Sector

The fashion and apparel sector is experiencing robust growth, which is likely to positively impact the Polyester Fiber Market. As fashion trends evolve, the demand for polyester fibers in clothing production is increasing. Reports suggest that The Polyester Fiber Market is projected to reach trillions of dollars in the coming years, with polyester fibers being a preferred choice due to their affordability and versatility. Additionally, the rise of fast fashion brands, which prioritize quick production cycles, is further driving the demand for polyester fibers. This trend indicates that the Polyester Fiber Market is well-positioned to benefit from the ongoing expansion of the fashion and apparel sector, potentially leading to increased market share and revenue.

Expanding Applications in Various Industries

The versatility of polyester fibers is contributing to their expanding applications across multiple industries, which is a key driver for the Polyester Fiber Market. From apparel to home furnishings and automotive textiles, polyester fibers are increasingly being utilized due to their durability and cost-effectiveness. The apparel segment, in particular, is projected to account for a significant share of the market, driven by the rising demand for activewear and athleisure products. Additionally, the automotive industry is incorporating polyester fibers in interior components, which is expected to boost market growth. As industries continue to explore new applications for polyester fibers, the Polyester Fiber Market is likely to see sustained demand and innovation.

Increasing Urbanization and Population Growth

Urbanization and population growth are significant factors influencing the Polyester Fiber Market. As more individuals migrate to urban areas, the demand for housing, clothing, and various consumer goods rises. This urban shift is likely to increase the consumption of polyester fibers, particularly in textiles and home furnishings. The growing population is also expected to drive demand for affordable and durable materials, which polyester fibers provide. Furthermore, as urban lifestyles evolve, the need for innovative and functional textiles is becoming more pronounced. This trend suggests that the Polyester Fiber Market may experience substantial growth as it adapts to the changing needs of urban consumers.

Technological Innovations in Fiber Production

Technological advancements in fiber production are likely to play a crucial role in shaping the Polyester Fiber Market. Innovations such as advanced spinning techniques and the development of high-performance polyester fibers are enhancing product quality and functionality. For instance, the introduction of smart textiles, which integrate technology into fabric, is gaining traction. This could lead to a substantial increase in applications across various sectors, including sportswear and medical textiles. Furthermore, the integration of automation and artificial intelligence in manufacturing processes is expected to improve efficiency and reduce costs, thereby making polyester fibers more competitive. As a result, the Polyester Fiber Market may experience accelerated growth driven by these technological innovations.