Market Analysis

In-depth Analysis of Polycaprolactone Polyol Market Industry Landscape

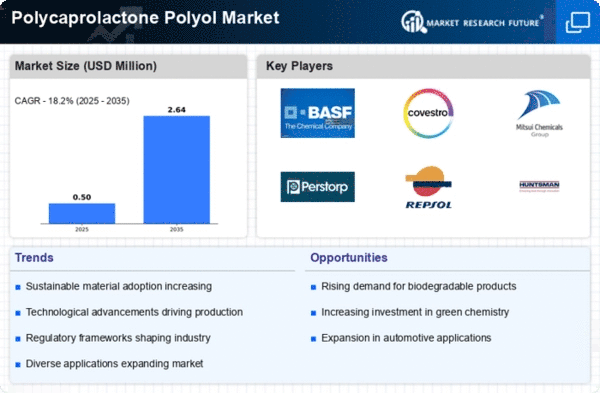

The growth trends and overall direction of the Polycaprolactone Polyol industry are influenced by different factors that determine its market dynamics. Adhesive coatings, elastomers, etcetera use polycaprolactone polyols derived from caprolactone monomer. Another factor driving up demand for polycaprolactone polyol is its use as a component in the production of high-performance polyurethane elastomers. With more emphasis being placed on strong and flexible materials, particularly in sectors such as automotive and construction, the demand for this product has skyrocketed, leading to a corresponding increase in that of polycaprolactone polyols. Additionally, the fact that it can decompose naturally appeals to several environmentally-minded customers and industry players whose numbers are increasing by the day. On the other hand, there are also challenges faced by market dynamics. Raw material price fluctuations represent one of these obstacles. Caprolactone monomer is an essential input in the PCL manufacturing process, whose supply and price depend on feedstock prices and demand forces, among others. These raw material price movements may directly affect the total cost of production, thus the price of Polycaprolactone Polyol on the market. Also, regulatory dynamics play a role in shaping market trends. The concern over environmental issues is growing; hence, the focus on eco-friendly products has increased. Regulatory changes leading to alterations in manufacturing processes or formulations have emerged within the PCL industry, resulting in new standards and regulations that have been put in place. Therefore, companies operating within this sector must be updated regarding legislation changes so that they can match the competition level. The good news is that technology plays an important role in shaping market trends of Polycaprolactone Polyol. Research and development has also seen the introduction of innovative production techniques and improved product formulations. These improvements not only improve the performance characteristics of Polycaprolactone Polyol but also contribute to cost-effectiveness, thus driving its adoption in many industries. End use industries influence the market dynamics. For example, the automotive industry is a major user of polycaprolactone polyol, which is used to manufacture seating foams, interior trims, and structural components. Growth in the automotive sector, coupled with increasing demand for lightweight and fuel-efficient vehicles, affects the market dynamics of Polycaprolactone Polyol.

Leave a Comment