Plus Size Clothing Market Summary

As per Market Research Future analysis, The Global Plus Size Clothing Market was estimated at 326.9 USD Billion in 2024. The plus size clothing industry is projected to grow from 346.19 USD Billion in 2025 to 614.15 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Plus Size Clothing Market is experiencing a transformative shift towards inclusivity and sustainability.

- The market is witnessing an increased focus on sustainability, with brands adopting eco-friendly practices.

- Online shopping continues to rise, significantly impacting consumer purchasing behaviors in the plus size segment.

- Body positivity is gaining traction, influencing design choices and marketing strategies across various brands.

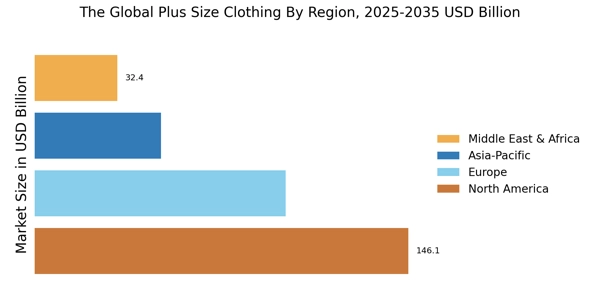

- The growing demand for inclusive fashion and technological advancements in retail are driving market expansion, particularly in North America and the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 326.9 (USD Billion) |

| 2035 Market Size | 614.15 (USD Billion) |

| CAGR (2025 - 2035) | 5.9% |

Major Players

Lane Bryant (US), Torrid (US), ASOS (GB), Avenue (US), Eloquii (US), Forever 21 (US), Zalando (DE), H&M (SE), Old Navy (US), Simply Be (GB)