Advancements in Manufacturing Processes

Advancements in manufacturing processes are reshaping the Platter Substrate Material Market. Innovations such as additive manufacturing and precision engineering are enabling the production of more complex and high-quality substrates. These advancements allow manufacturers to create customized solutions that cater to specific industry needs, thereby enhancing product performance. The market for advanced manufacturing technologies is anticipated to grow at a rate of 6% per year, which could lead to a surge in the availability of specialized platter substrates. This evolution in manufacturing not only improves efficiency but also reduces waste, aligning with broader sustainability goals.

Growth in Renewable Energy Technologies

The expansion of renewable energy technologies is significantly influencing the Platter Substrate Material Market. As the world shifts towards sustainable energy solutions, the demand for efficient and durable materials in solar panels and wind turbines is on the rise. Platter substrates play a crucial role in enhancing the efficiency and longevity of these technologies. Recent statistics suggest that the renewable energy sector is expected to witness a growth rate of around 8% annually, which could lead to increased investments in high-quality platter substrates. This trend not only supports environmental goals but also drives innovation within the substrate material market.

Emerging Applications in Automotive Industry

Emerging applications in the automotive industry are significantly impacting the Platter Substrate Material Market. With the rise of electric vehicles and advanced driver-assistance systems, there is a growing need for high-quality substrates that can withstand extreme conditions and provide reliable performance. The automotive sector is increasingly adopting advanced materials to enhance vehicle efficiency and safety. Market analysis indicates that the automotive industry is expected to grow at a rate of 4% annually, which could lead to heightened demand for specialized platter substrates. This trend underscores the importance of adapting to new market needs and technological advancements.

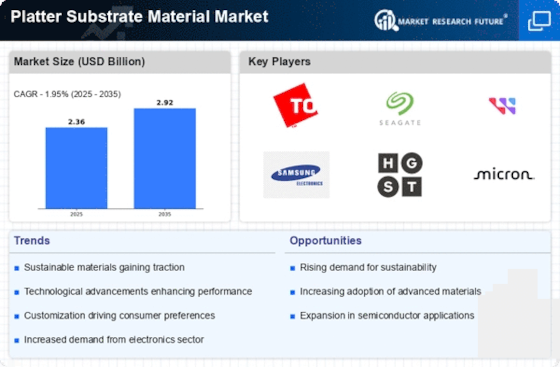

Rising Demand for High-Performance Electronics

The increasing demand for high-performance electronics is a pivotal driver in the Platter Substrate Material Market. As consumer electronics evolve, the need for advanced materials that can support faster processing speeds and higher data transfer rates becomes paramount. This trend is particularly evident in sectors such as telecommunications and computing, where the integration of sophisticated technologies necessitates the use of specialized platter substrates. Market data indicates that the electronics sector is projected to grow at a compound annual growth rate of approximately 5% over the next five years, further fueling the demand for innovative platter substrate materials that can meet these stringent performance requirements.

Increased Investment in Research and Development

Increased investment in research and development is a critical driver for the Platter Substrate Material Market. Companies are allocating substantial resources to innovate and develop new materials that can meet the evolving demands of various applications. This focus on R&D is essential for staying competitive in a rapidly changing market landscape. Data suggests that R&D spending in the materials sector is projected to rise by approximately 7% annually, indicating a strong commitment to advancing platter substrate technologies. This investment not only fosters innovation but also enhances the overall quality and performance of substrate materials.