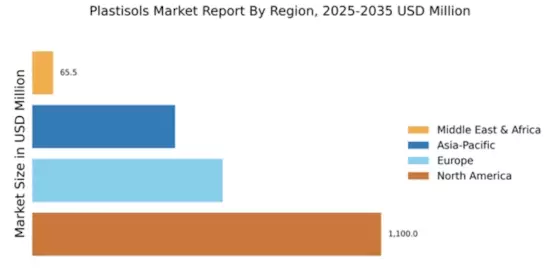

North America : Market Leader in Plastisols

North America is poised to maintain its leadership in the Plastisols market, holding a significant share of 1100.0 million. The region's growth is driven by robust demand in automotive, construction, and consumer goods sectors. Regulatory support for sustainable materials and innovations in manufacturing processes further catalyze market expansion. The increasing adoption of Plastisols in various applications underscores the region's pivotal role in the global landscape. The United States stands as the primary market, with key players like BASF, DuPont, and Huntsman leading the charge. The competitive landscape is characterized by continuous innovation and strategic partnerships among major companies. The presence of advanced manufacturing facilities and a skilled workforce enhances the region's capability to meet growing demand, ensuring North America's dominance in the Plastisols market.

Europe : Emerging Market Dynamics

Europe's Plastisols market is projected to grow significantly, with a market size of 600.0 million. The region benefits from stringent regulations promoting eco-friendly materials, driving demand for sustainable Plastisol solutions. Innovations in product formulations and applications in automotive and healthcare sectors are key growth drivers. The increasing focus on reducing carbon footprints aligns with regulatory frameworks, enhancing market prospects. Leading countries such as Germany, France, and the UK are at the forefront of this growth, with major players like Solvay and Eastman Chemical Company actively participating. The competitive landscape is marked by collaborations and investments in R&D to develop advanced Plastisol products. The presence of established manufacturing hubs further strengthens Europe's position in the global market.

Asia-Pacific : Rapid Growth Potential

The Asia-Pacific Plastisols market, valued at 400.0 million, is experiencing rapid growth due to increasing industrialization and urbanization. Countries like China and India are leading this growth, driven by rising demand in automotive, textiles, and construction sectors.

Driven by the "Make in India" initiative, the India Plastisol Market is seeing a rapid expansion in the automotive component sector, specifically for underbody sealants and anti-corrosive coatings that improve vehicle longevity. The region's diverse applications for Plastisols are expected to drive significant growth in the coming years.

China stands out as the largest market in the region, with substantial investments in manufacturing capabilities. The competitive landscape features key players such as Eastman Chemical Company and PolyOne Corporation, who are focusing on innovation and product development. The growing emphasis on quality and performance in Plastisols applications is likely to enhance the region's market position, making Asia-Pacific a vital area for future investments.

Middle East and Africa : Niche Market Opportunities

The Middle East and Africa (MEA) Plastisols market, valued at 115.47 million, is gradually emerging as a significant player in the global landscape. The growth is primarily driven by increasing demand in construction and automotive sectors, alongside a rising focus on industrialization. As a strategic logistics hub, the UAE Plastisol Market is also seeing a rise in demand for specialized packaging sealants and metal finishing products used in the Middle-East booming regional construction and aerospace industries. The region's unique challenges also present opportunities for innovation and development in Plastisols applications.

Leading countries in the MEA region include South Africa and the UAE, where local players are beginning to establish a foothold in the market. The competitive landscape is evolving, with companies focusing on strategic partnerships and collaborations to enhance their market presence. As the region continues to develop, the Plastisols market is poised for growth, driven by increasing investments and a focus on sustainability.