Top Industry Leaders in the Plasticizers Market

– the unsung heroes of the plastic world – lend flexibility and durability to countless everyday objects, from medical tubing to clothing and even car interiors. But the market behind these invisible enhancers is anything but pliable. Let's delve into the dynamic terrain of the plasticizer market, uncovering the strategies, drivers, and recent tremors shaping this ever-evolving landscape.

– the unsung heroes of the plastic world – lend flexibility and durability to countless everyday objects, from medical tubing to clothing and even car interiors. But the market behind these invisible enhancers is anything but pliable. Let's delve into the dynamic terrain of the plasticizer market, uncovering the strategies, drivers, and recent tremors shaping this ever-evolving landscape.

Strategies Shaping the Market Landscape:

-

Diversification Drive: Major players like BASF, ExxonMobil, and Evonik Industries broaden their product offerings, catering to diverse applications and regional demands. -

Sustainability Sprint: Eco-friendly alternatives like non-phthalate plasticizers are gaining traction, driven by environmental concerns and regulations. Companies like Eastman Chemical and Lanxess are leading the charge with bio-based and bio-degradable options. -

Cost Efficiency Crusade: Technological advancements in production processes and raw material sourcing help players like LG Chem and INEOS improve cost competitiveness, particularly in price-sensitive segments. -

Regional Anchors: Local champions like Shandong Qilu Plasticizers in China and Nan Ya Plastics in Asia leverage their understanding of regional regulations and supply chains to carve out strong positions. -

M&A Maneuvers: Mergers and acquisitions, like ExxonMobil acquiring US-based plasticizer manufacturer Kraton Corporation, are happening, consolidating market share and expertise.

Market Share Movers and Shakers:

-

Global Giants: BASF, ExxonMobil, and Evonik Industries hold significant market share due to their vast production capacities, established distribution networks, and diverse product portfolios. -

Regional Champions: Shandong Qilu and Nan Ya Plastics dominate their respective regions through cost-effective production, catering to local demand, and building strategic partnerships. -

Niche Specialists: Smaller players like Lanxess and Eastman Chemical differentiate themselves through innovative, environmentally friendly plasticizers and customized solutions for specific applications.

Factors Influencing Market Share:

-

Construction Boom: Increasing construction activity in developing economies fuels demand for flexible PVC pipes, cables, and flooring, driving plasticizer consumption. -

Automotive Rebound: The rebounding automotive industry, particularly electric vehicle production, creates opportunities for plasticizers in interior components and wiring systems. -

Environmental Regulations: Stringent regulations on traditional phthalates prompt a shift towards non-phthalate alternatives, impacting market dynamics. -

Fluctuating Raw Material Prices: Oil price volatility and supply chain disruptions affect the cost of key feedstocks like ethylene glycol, impacting production costs and profitability.

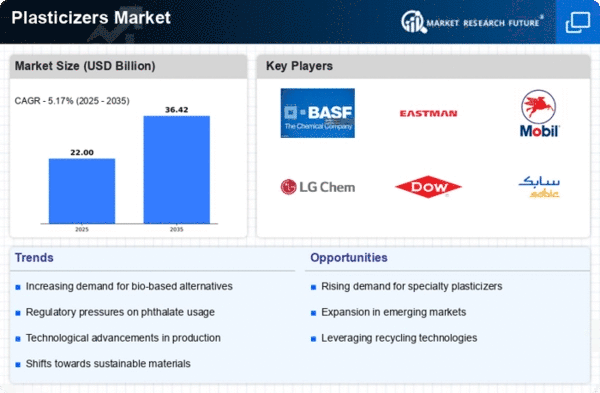

Key Players:

-

BASF SE (Germany)

-

DIC Corporation (Japan)

-

LG Chem (South Korea)

-

Evonik (Germany)

-

Exxon Mobil Corporation (US)

-

Lanxess AG (Germany)

-

Nan Ya Plastics (Taiwan)

-

KAO Corporation (Japan)

-

Polynt SPA (Italy)

-

KLJ Group (India)

-

Polyone Corporation (US)

-

Jiangsu Zhengdan Chemical Industry Co. Ltd. (China)

-

OXEA GmbH (Germany)

-

Vertellus Holdings LLC (US)

-

Dahin Co. (Taiwan)

Recent Developments: Bending the Curve :

July 2023: ExxonMobil partners with a Chinese company to build a new plasticizer manufacturing plant in Asia, aiming to capitalize on the regional demand.

September 2023: LG Chem introduces a new line of fire-retardant plasticizers for safety-critical applications like building materials and transportation.

October 2023: INEOS invests in a technology upgrade at its European plasticizer facility, aiming to improve efficiency and reduce environmental impact.

November 2023: Lanxess launches a digital platform for sourcing and comparing plasticizers, aimed at enhancing market transparency and customer convenience.