Plastic Packaging Market Summary

As per Market Research Future analysis, The Global Plastic Packaging Market Size was estimated at 360.86 USD Billion in 2024. The plastic packaging industry is projected to grow from 376.24 USD Billion in 2025 to 571.12 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Plastic Packaging Market is experiencing a transformative shift towards sustainability and innovation.

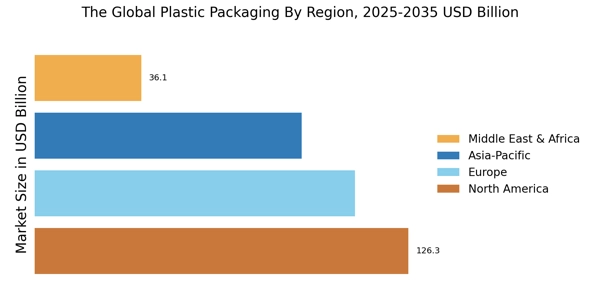

- North America remains the largest market for plastic packaging, driven by robust demand in the food and beverages sector.

- The Asia-Pacific region is recognized as the fastest-growing market, propelled by increasing urbanization and rising disposable incomes.

- Rigid packaging continues to dominate the market, while flexible packaging is emerging rapidly due to its versatility and convenience.

- Key market drivers include the rising emphasis on sustainable packaging solutions and technological advancements in packaging design.

Market Size & Forecast

| 2024 Market Size | 360.86 (USD Billion) |

| 2035 Market Size | 571.12 (USD Billion) |

| CAGR (2025 - 2035) | 4.26% |

Major Players

Amcor (Switzerland), Berry Global (USA), Sealed Air (USA), ALPLA (Austria), AptarGroup (USA), Plastipak Packaging (USA), Greiner Packaging (Austria), Constantia Flexibles (Austria), Silgan Holdings (USA), Sonoco Products (USA)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review