Market Share

Plant Growth Regulators Market Share Analysis

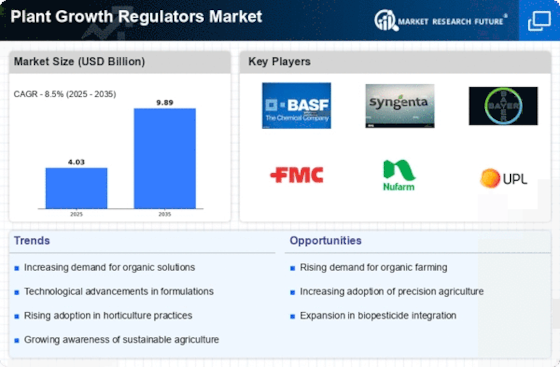

The Plant Growth Regulators (PGR) market is changing due to agricultural sector dynamics and the focus on sustainable crop management. PGRs are becoming crucial instruments for agricultural output and quality. Farmers are realizing that PGRs regulate plant physiological processes including blooming, fruit development, and stem elongation, improving crop performance. This trend supports the industrial objective of increasing production while reducing resource consumption and environmental impact. PGRs tackle specialty crop production issues such fruit size, color, and consistency. This shows that PGRs are becoming more important for precision agriculture in horticulture.

Global sustainable agriculture is affecting the Plant Growth Regulators industry. Sustainable farming emphasizes resource efficiency and environmental protection. PGRs maximize plant growth, reduce fertilizer use, and improve crop stress tolerance, encouraging sustainability. The industry supports responsible agriculture that addresses economic and environmental issues. Climate change requires crops to adapt to changing environmental circumstances, making PGRs an important aspect of sustainable farming.

Novel PGR compositions and application strategies are also emerging. PGR product efficiency, stability, and usability are being enhanced by manufacturers via research and development. Advanced formulation methods including microencapsulation and nanotechnology improve PGR distribution and performance. Precision application strategies including foliar sprays and controlled-release formulations help target and efficiently employ PGRs in diverse crops and production systems.

The market is also becoming more aware of PGRs' involvement in crop abiotic stress mitigation. Climate unpredictability, severe temperatures, and water scarcity hamper crop productivity, but PGRs improve plant stress tolerance. In climate-vulnerable places, judicious PGR application can help crops survive and thrive.

In conclusion, the Plant Growth Regulators market is driven by crop enhancement, specialty crops and horticulture, sustainable agriculture, novel formulations and application methods, and abiotic stress mitigation. These trends show the industry's reaction to crop management's demand for innovation and sustainability. As the global agricultural industry evolves, Plant Growth Regulators market stakeholders may face new possibilities and difficulties in addressing producers' desire for effective and environmentally friendly crop improvement technologies.

Leave a Comment