Expansion of Oil and Gas Sector

The expansion of the oil and gas sector is a crucial driver for The Pipe Coating Market . As exploration and production activities increase, the need for reliable and durable pipe coatings becomes paramount. The oil and gas industry is expected to witness a growth rate of around 4% annually, leading to heightened demand for protective coatings that can withstand harsh environments. Coatings that provide thermal insulation and corrosion resistance are particularly sought after, as they ensure the integrity of pipelines. This trend indicates a robust market for pipe coatings tailored to meet the specific requirements of the oil and gas sector, thereby contributing to the overall growth of the industry.

Infrastructure Investment Initiatives

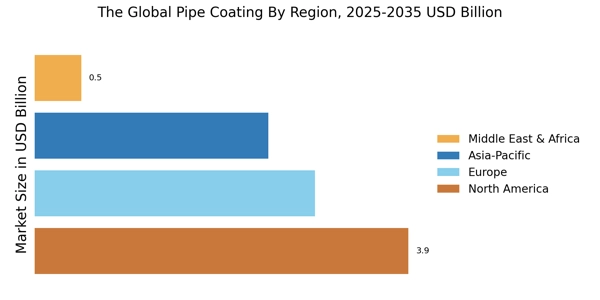

Infrastructure investment initiatives are significantly influencing The Global Pipe Coating Industry. Governments and private entities are increasingly allocating funds for infrastructure development, particularly in emerging economies. This trend is expected to result in a market growth rate of approximately 6% over the next five years. Investments in water supply systems, sewage treatment plants, and transportation networks necessitate the use of high-performance pipe coatings to ensure longevity and reliability. The focus on modernizing aging infrastructure further amplifies the demand for innovative coating solutions that can enhance the performance of pipes in various applications. Consequently, this driver is pivotal in shaping the future landscape of the pipe coating market.

Rising Demand for Corrosion Resistance

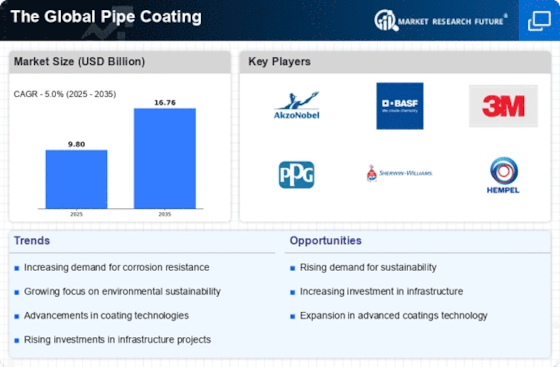

The increasing need for corrosion-resistant materials in various industries drives The Global Pipe Coating . Corrosion can lead to significant financial losses and safety hazards, prompting industries such as oil and gas, water treatment, and construction to seek effective solutions. The market for corrosion-resistant coatings is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is attributed to the rising awareness of the detrimental effects of corrosion on infrastructure and equipment. As a result, companies are investing in advanced coating technologies that enhance durability and longevity, thereby boosting the demand for pipe coatings that offer superior corrosion protection.

Environmental Regulations and Standards

The implementation of stringent environmental regulations and standards is a significant driver for The Pipe Coating . Governments worldwide are increasingly enforcing regulations aimed at reducing environmental impact, which includes the use of eco-friendly coatings. The market for environmentally compliant coatings is projected to grow as industries seek to adhere to these regulations. This shift towards sustainable practices is likely to result in a compound annual growth rate of around 5% for eco-friendly pipe coatings. Companies are investing in research and development to create coatings that not only meet regulatory requirements but also offer enhanced performance. This trend underscores the importance of sustainability in the future of the pipe coating market.

Technological Innovations in Coating Solutions

Technological innovations in coating solutions are reshaping The Pipe Coating . Advances in material science and application techniques are leading to the development of high-performance coatings that offer superior protection and efficiency. Innovations such as nanotechnology and smart coatings are gaining traction, providing enhanced properties like self-healing and improved adhesion. The market is expected to experience a growth rate of approximately 7% as these technologies become more prevalent. As industries seek to optimize their operations and reduce maintenance costs, the demand for advanced coating solutions is likely to increase. This driver highlights the critical role of technology in enhancing the performance and longevity of pipe coatings.