Growth in the Aquaculture Sector

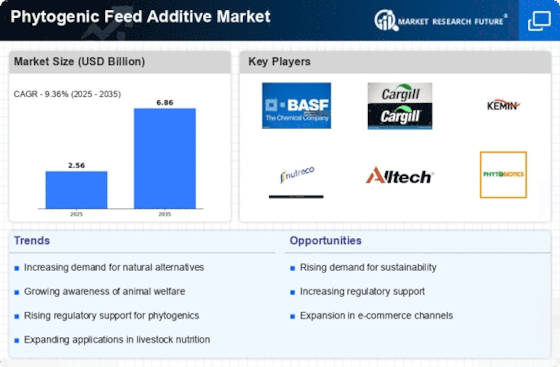

The Phytogenic Feed Additive Market is poised for growth, particularly due to the expansion of the aquaculture sector. As the global demand for seafood continues to rise, aquaculture operations are increasingly adopting phytogenic feed additives to enhance fish health and growth. These natural additives are recognized for their ability to improve feed efficiency and reduce disease incidence in aquatic species. Market projections indicate that the aquaculture segment could account for a significant share of the phytogenic feed additive market, potentially reaching a valuation of several billion dollars in the near future. This growth reflects the industry's shift towards more sustainable practices, where phytogenic solutions play a crucial role in meeting the nutritional needs of farmed fish.

Regulatory Support for Natural Feed Additives

The Phytogenic Feed Additive Market benefits from increasing regulatory support for natural feed additives. Governments and regulatory bodies are progressively recognizing the advantages of phytogenic substances in animal nutrition. This support is evident in the formulation of guidelines that encourage the use of natural ingredients over synthetic alternatives. As regulations evolve, the market for phytogenic feed additives is likely to see accelerated growth. For instance, certain regions have reported a rise in the approval of phytogenic products, which could lead to a market expansion valued at over a billion dollars in the coming years. This regulatory environment fosters innovation and encourages manufacturers to invest in research and development, further propelling the industry forward.

Increasing Consumer Awareness of Animal Welfare

The Phytogenic Feed Additive Market is experiencing a notable shift as consumers become increasingly aware of animal welfare issues. This heightened awareness drives demand for feed additives that promote health and well-being in livestock. As consumers seek transparency in food production, producers are compelled to adopt practices that align with these values. Consequently, the market for phytogenic feed additives, which are perceived as more humane and natural, is likely to expand. Reports indicate that the market could reach a valuation of several billion dollars by the end of the decade, reflecting the growing preference for sustainable and ethical farming practices. This trend suggests that companies focusing on animal welfare through phytogenic solutions may gain a competitive edge in the market.

Rising Demand for Sustainable Livestock Production

The Phytogenic Feed Additive Market is significantly influenced by the rising demand for sustainable livestock production. As environmental concerns escalate, producers are increasingly seeking alternatives to conventional feed additives that may have adverse ecological impacts. Phytogenic feed additives, derived from natural plant sources, offer a sustainable solution that aligns with the principles of eco-friendly farming. Market analysis suggests that the demand for these additives could grow substantially, potentially reaching a market size of several billion dollars by the end of the decade. This trend indicates a shift towards more responsible farming practices, where phytogenic solutions are favored for their minimal environmental footprint and health benefits for livestock.

Technological Innovations in Phytogenic Extraction

The Phytogenic Feed Additive Market is witnessing a surge in technological innovations related to the extraction of phytogenic compounds. Advances in extraction methods, such as supercritical fluid extraction and cold pressing, enhance the efficiency and efficacy of phytogenic feed additives. These innovations not only improve the quality of the additives but also reduce production costs, making them more accessible to livestock producers. As a result, the market is likely to experience significant growth, with estimates suggesting a potential market size of several billion dollars in the coming years. This technological progress indicates a promising future for the phytogenic feed additive industry, as it aligns with the increasing demand for high-quality, natural feed solutions.