Sustainability Trends

Sustainability trends are increasingly shaping the Global Photoresist Market Industry, as manufacturers seek to reduce their environmental impact. The growing emphasis on eco-friendly materials and processes is prompting companies to innovate in the development of sustainable photoresist solutions. This shift not only aligns with global environmental goals but also meets the demands of environmentally conscious consumers. As regulations become stricter and sustainability becomes a priority, the Global Photoresist Market Industry is likely to adapt, fostering the development of greener alternatives that could redefine industry standards.

Market Growth Projections

The Global Photoresist Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 5.28 USD Billion in 2024, the industry is expected to expand to 9.53 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.51% from 2025 to 2035. Such projections indicate a robust demand for photoresist materials, driven by advancements in technology and increasing applications in various sectors. The market's expansion reflects the critical role that photoresists play in the semiconductor manufacturing process, underscoring their importance in the evolving technological landscape.

Emerging Markets Expansion

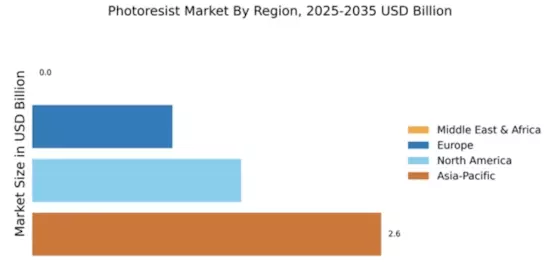

The expansion of emerging markets is a crucial factor driving the Global Photoresist Market Industry. Countries in Asia-Pacific, particularly China and India, are witnessing rapid industrialization and urbanization, leading to increased investments in semiconductor manufacturing. As these nations strive to enhance their technological capabilities, the demand for photoresists is expected to rise. This trend is indicative of a broader shift in the global supply chain, where emerging markets are becoming key players. The Global Photoresist Market Industry is likely to benefit from this expansion, potentially leading to a compound annual growth rate of 5.51% from 2025 to 2035.

Technological Advancements

The Global Photoresist Market Industry is experiencing a surge in demand driven by rapid technological advancements in semiconductor manufacturing. Innovations in photolithography techniques and materials are enhancing the performance and efficiency of photoresists. For instance, the introduction of extreme ultraviolet lithography is enabling the production of smaller and more complex semiconductor devices. This trend is projected to contribute to the market's growth, with the industry expected to reach 5.28 USD Billion in 2024. As manufacturers adopt these advanced technologies, the Global Photoresist Market Industry is likely to witness a significant transformation, fostering a competitive landscape.

Rising Demand for Electronics

The increasing global demand for consumer electronics is a pivotal driver for the Global Photoresist Market Industry. As the proliferation of smartphones, tablets, and wearable devices continues, the need for advanced semiconductor components rises correspondingly. This demand is anticipated to propel the market, with projections indicating a growth to 9.53 USD Billion by 2035. The integration of photoresists in the manufacturing of these electronic devices is crucial, as they play a vital role in defining circuit patterns. Consequently, the Global Photoresist Market Industry is positioned to benefit from this ongoing trend, suggesting a robust growth trajectory.

Government Initiatives and Investments

Government initiatives aimed at bolstering the semiconductor industry are significantly influencing the Global Photoresist Market Industry. Various countries are implementing policies and providing financial support to enhance domestic semiconductor manufacturing capabilities. For example, initiatives in regions like North America and Asia are focused on reducing reliance on foreign semiconductor supply chains. These efforts are likely to stimulate growth in the photoresist sector, as increased production capacity will necessitate higher volumes of photoresist materials. The Global Photoresist Market Industry stands to gain from these investments, which may lead to a more resilient and self-sufficient semiconductor ecosystem.