Rising Demand for Corrosion Resistance

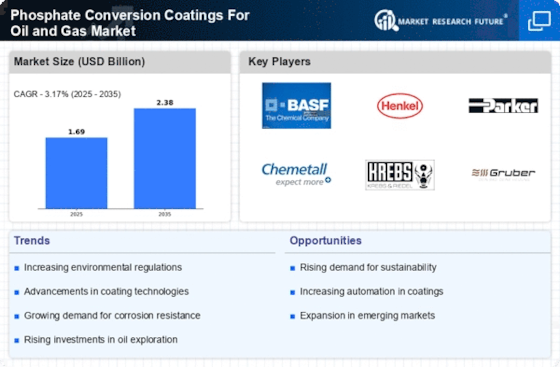

The increasing need for corrosion resistance in the oil and gas sector drives the Phosphate Conversion Coatings For Oil and Gas Market. Corrosion can lead to significant operational disruptions and financial losses, prompting companies to seek effective protective solutions. Phosphate conversion coatings provide a robust barrier against corrosive elements, thereby enhancing the longevity of equipment and infrastructure. As the oil and gas industry continues to expand, the demand for reliable coatings is expected to rise. Reports indicate that the market for corrosion protection coatings is projected to grow at a compound annual growth rate of approximately 5% over the next few years, underscoring the importance of phosphate conversion coatings in maintaining operational efficiency.

Environmental Regulations and Compliance

The stringent environmental regulations imposed on the oil and gas industry significantly influence the Phosphate Conversion Coatings For Oil and Gas Market. Governments worldwide are enforcing stricter guidelines to minimize environmental impact, which includes the use of eco-friendly coatings. Phosphate conversion coatings are often favored due to their lower environmental footprint compared to traditional coatings. Compliance with these regulations not only helps companies avoid penalties but also enhances their reputation among stakeholders. As regulatory frameworks continue to evolve, the demand for phosphate conversion coatings that meet these standards is expected to grow, thereby shaping the market landscape.

Growing Focus on Asset Integrity Management

The growing emphasis on asset integrity management within the oil and gas industry is a significant driver for the Phosphate Conversion Coatings For Oil and Gas Market. Companies are increasingly recognizing the importance of maintaining the integrity of their assets to ensure safety and operational efficiency. Phosphate conversion coatings play a crucial role in this regard by providing a protective layer that helps prevent corrosion and degradation. As organizations invest in asset management strategies, the demand for effective coatings is expected to rise. This focus on asset integrity not only enhances safety but also contributes to cost savings, further solidifying the role of phosphate conversion coatings in the industry.

Increased Exploration and Production Activities

The surge in exploration and production activities in the oil and gas sector is a key driver for the Phosphate Conversion Coatings For Oil and Gas Market. As companies venture into new and challenging environments, the need for durable and effective coatings becomes paramount. Phosphate conversion coatings offer excellent adhesion and corrosion resistance, making them suitable for various applications in harsh conditions. The International Energy Agency projects a steady increase in global oil and gas production, which will likely lead to heightened demand for protective coatings. This trend indicates a robust market potential for phosphate conversion coatings as companies seek to protect their investments.

Technological Innovations in Coating Applications

Technological advancements in coating applications are reshaping the Phosphate Conversion Coatings For Oil and Gas Market. Innovations such as improved application techniques and enhanced coating formulations are making phosphate coatings more effective and easier to apply. These advancements not only improve the performance of the coatings but also reduce application time and costs. The integration of automation and robotics in the application process is also gaining traction, leading to more consistent and high-quality coatings. As companies strive for operational excellence, the adoption of these technologies is likely to increase, further driving the demand for phosphate conversion coatings in the oil and gas sector.