Market Analysis

In-depth Analysis of Pharmaceutical Robots Market Industry Landscape

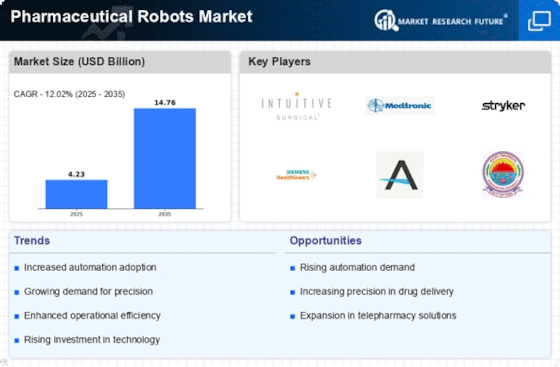

The Automatized Pharmaceutical Robots Market isn’t just another area where science and creative imagination meet; instead, it is where the industry keeps evolving while adapting to new needs. The market dynamics of this area are shaped by two factors: rising sophistication and efficiency in pharmaceutical process, regulations, economic factors, as well as inter-organizational partnerships among the key players. An important power, which has a huge bearing on the dynamics of the market, comes with ceaseless progress made in robotics. Data pulsate upwards as overall industry progresses to complex processes requiring robotic automation and systems options for functions such as dispensing, packaging, and labelling with the accuracy and speed.

Research and development, among the key factors that form the foundation of medical robots market will be identified and analyzed in this paper. Firms and institutions are not idle and here to to improve robotic tech to fit exactly in various software and hardware of the pharmaceutical industry. The competitive landscape is not an exception to the rule of continuous improvement, new technologies are emanated and robotic systems are continually grown capable in drug compounding, sample analysis and handling hazardous materials. The corollaries of the market are illustrated as freshman/manufacturers procure robotic tools for the myriad tasks while exploring new ways to improve current solutions to meet diverse needs.

Regulation plays an important role in creating forces in an environment for pharmaceutical robots. Robotic systems by virtue of their application in the pharmaceutical industry is subject to rigorous regulations in order to maintain compliance with good practices for safety, quality and data integrity. To ensure maximum competitiveness in this market, meeting pharmaceutical regulatory requirements is a must and it will determine the entire competitive landscape and also create a trust among the manufacturers who would be willing to adopt the robotic technologies.

It all started with a small team meeting in a lab in 2004 when a group of scientists had an idea for creating an automatic device that can take care of the pharmaceutical organization. Therefore, since the pharmaceutical sector tends to accelerate productivity, deliver on time and meet regulatory standards through the implementation of robotic systems, the integration of the robot systems becomes part of their routine operations. This shift not only rearranges the pattern of the market but also draws the picture of robotics gene in the pharmaceutical sector in which robots would contribute in humanizing the area and conform to the standards in terms of accuracy and compliance to the ethics.

Economic factors affect the dynamics of market and ensure that pharmaceutical robots are both effective and profitable in the given market design. The affordability and long-term benefits of robotic automation which are the key drivers for companies to incorporate these technologies is a reflection of the adoption of the same by the pharmaceutical manufacturers. With market tendencies being determined by economic factors, ensuring that robotics in the pharmacy sector remain within the reach of smaller and medium-sized companies is a key factor.

Leave a Comment