Market Growth Projections

The Global Pharmaceutical Manufacturing Market Industry is poised for substantial growth, with projections indicating a market value of 434.0 USD Billion in 2024 and an anticipated increase to 590 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 2.83% from 2025 to 2035. Various factors contribute to this upward trend, including technological advancements, increasing demand for biopharmaceuticals, and the expansion into emerging markets. The industry is adapting to changing consumer needs and regulatory landscapes, positioning itself for sustained growth in the coming years.

Rising Demand for Biopharmaceuticals

The Global Pharmaceutical Manufacturing Market Industry experiences a notable surge in demand for biopharmaceuticals, driven by advancements in biotechnology and personalized medicine. As patients increasingly seek tailored treatments, the industry adapts by focusing on biologics, which are projected to account for a significant portion of the market. In 2024, the market is valued at approximately 434.0 USD Billion, with biopharmaceuticals playing a crucial role in this growth. The shift towards biologics not only enhances treatment efficacy but also contributes to the overall expansion of the Global Pharmaceutical Manufacturing Market Industry, as companies invest in innovative production technologies and processes.

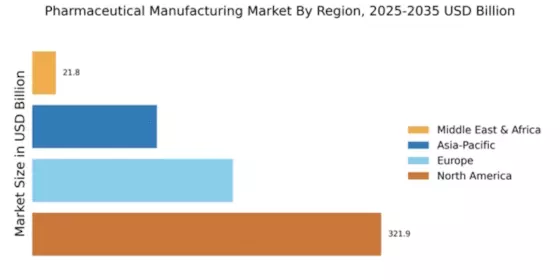

Emerging Markets and Global Expansion

Emerging markets present substantial opportunities for the Global Pharmaceutical Manufacturing Market Industry, as economic growth and increasing healthcare access drive demand for pharmaceuticals. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization and rising disposable incomes, leading to greater healthcare expenditure. Pharmaceutical companies are strategically expanding their operations into these regions to capitalize on the growing market potential. This expansion not only enhances global reach but also fosters local manufacturing capabilities, contributing to the overall growth of the industry. As the market evolves, the Global Pharmaceutical Manufacturing Market Industry is likely to see increased competition and innovation in these emerging markets.

Global Aging Population and Chronic Diseases

The Global Pharmaceutical Manufacturing Market Industry is significantly influenced by the aging population and the rising prevalence of chronic diseases. As the global demographic shifts towards an older population, there is a corresponding increase in the demand for pharmaceuticals that address age-related health issues. Chronic diseases such as diabetes, cardiovascular conditions, and cancer require ongoing treatment, thereby driving the need for innovative drug development and manufacturing. This trend is expected to contribute to the market's growth, with projections indicating a market value of 590 USD Billion by 2035. The industry's response to these demographic changes underscores its critical role in addressing global health challenges.

Increasing Regulatory Compliance Requirements

The Global Pharmaceutical Manufacturing Market Industry faces stringent regulatory compliance requirements, which, while challenging, also drive innovation and quality improvements. Regulatory bodies worldwide are enhancing their oversight to ensure drug safety and efficacy, prompting manufacturers to adopt more rigorous quality assurance practices. This trend necessitates investment in advanced manufacturing technologies and processes to meet compliance standards. As a result, companies are likely to experience increased operational costs, yet this could also lead to higher product quality and consumer trust. The market's growth trajectory, with a projected CAGR of 2.83% from 2025 to 2035, reflects the industry's adaptation to these evolving regulatory landscapes.

Technological Advancements in Manufacturing Processes

Technological innovations are reshaping the Global Pharmaceutical Manufacturing Market Industry, enhancing efficiency and productivity. Automation, artificial intelligence, and advanced analytics are increasingly integrated into manufacturing processes, leading to improved quality control and reduced production costs. For instance, the adoption of continuous manufacturing techniques allows for more streamlined operations, resulting in faster time-to-market for new drugs. As the industry evolves, these technologies are expected to drive growth, with the market projected to reach 590 USD Billion by 2035. The ongoing investment in technology not only optimizes production but also aligns with regulatory requirements, ensuring compliance and safety in the Global Pharmaceutical Manufacturing Market Industry.