Market Trends

Key Emerging Trends in the Pharmaceutical HDPE Bottles Market

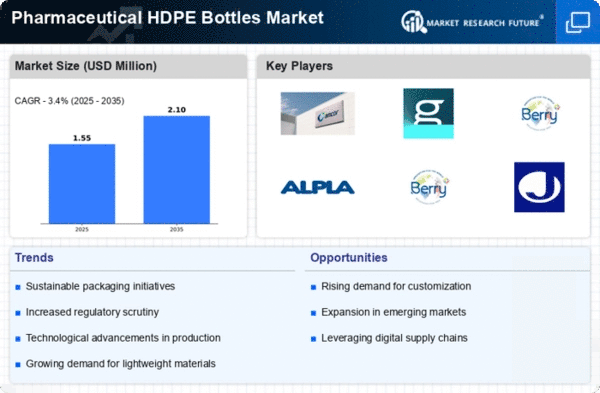

The market trends of pharmaceutical High-Density Polyethylene (HDPE) bottles are experiencing notable shifts influenced by factors such as regulatory requirements, technological advancements, and growing concerns about patient safety. One prominent trend in this market is the increasing emphasis on child-resistant packaging. As pharmaceutical products become more diverse and accessible, there is a heightened focus on packaging designs that prevent accidental ingestion by children. Child-resistant closures and tamper-evident features incorporated into HDPE bottles are becoming standard requirements, aligning with stringent regulations aimed at enhancing medication safety.

Moreover, there is a noticeable move towards sustainable packaging solutions in the pharmaceutical HDPE bottle market. With the broader industry push for environmentally friendly practices, pharmaceutical companies are seeking packaging materials that minimize their ecological footprint. HDPE, being recyclable, lightweight, and versatile, is gaining traction as a sustainable choice for pharmaceutical packaging. This trend reflects the growing awareness of the environmental impact of plastic usage and a commitment to more responsible packaging practices within the pharmaceutical sector.

Technological advancements are playing a crucial role in reshaping the pharmaceutical HDPE bottle market. Manufacturers are exploring innovations such as barrier coatings to enhance the performance of HDPE bottles. These coatings help protect pharmaceutical products from external factors like light, moisture, and oxygen, ensuring the stability and efficacy of the medications. Additionally, advancements in manufacturing processes are allowing for the production of HDPE bottles with precise dosing features, improving the accuracy and convenience of medication administration.

Furthermore, serialization and track-and-trace technologies are gaining prominence in the pharmaceutical packaging sector, including HDPE bottles. With an increasing focus on combating counterfeit drugs and ensuring supply chain transparency, pharmaceutical companies are implementing serialization to uniquely identify and trace individual drug packages. This trend enhances patient safety and regulatory compliance by allowing for the monitoring of the entire journey of pharmaceutical products from production to distribution.

The market is also witnessing a shift towards personalized medicine, influencing the design and functionality of pharmaceutical HDPE bottles. As pharmaceutical companies develop targeted therapies and individualized treatment plans, there is a need for packaging that accommodates varying dosage requirements. HDPE bottles with customizable dosing mechanisms, such as calibrated droppers or dispensing caps, are gaining traction to facilitate the precise administration of medications tailored to specific patient needs.

Additionally, the pharmaceutical HDPE bottle market is responding to the global health crisis by adapting to the increased demand for vaccines and other critical pharmaceutical products. HDPE bottles are well-suited for the storage and transportation of vaccines, offering durability, chemical resistance, and compatibility with a wide range of pharmaceutical formulations. The urgency of vaccine distribution and the need for reliable packaging solutions have further emphasized the importance of pharmaceutical HDPE bottles in the current healthcare landscape.

In terms of market dynamics, competition among pharmaceutical HDPE bottle manufacturers is intensifying. Companies are investing in research and development to enhance the barrier properties, sustainability, and technological features of their HDPE bottles. Meeting regulatory standards and addressing the specific needs of pharmaceutical clients are critical factors for success in this market. As the pharmaceutical industry continues to evolve, the demand for advanced and reliable HDPE packaging solutions is expected to grow.

Leave a Comment