Growth in Biopharmaceuticals

The Pharmaceutical Grade Silica Gel Market is witnessing growth driven by the expanding biopharmaceutical sector. Biopharmaceuticals, which include biologics and biosimilars, require specialized excipients for formulation and stability. Silica gel serves as an effective carrier for these complex molecules, ensuring their integrity and bioavailability. The biopharmaceutical market has been growing at a compound annual growth rate of around 7%, indicating a robust demand for high-quality excipients. This trend suggests that pharmaceutical companies are increasingly turning to silica gel to enhance the performance of their biopharmaceutical products. As the industry evolves, the need for innovative excipients like pharmaceutical-grade silica gel is likely to increase, further solidifying its role in drug development.

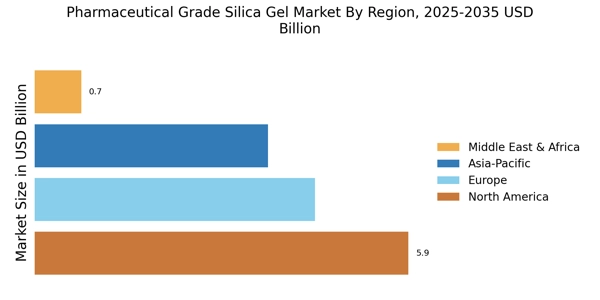

Expansion of Emerging Markets

The Pharmaceutical Grade Silica Gel Market is benefiting from the expansion of emerging markets, where the pharmaceutical sector is rapidly developing. Countries in Asia and Latin America are witnessing increased investments in healthcare infrastructure and pharmaceutical manufacturing. This growth is accompanied by a rising demand for high-quality excipients, including silica gel, to support the production of various pharmaceutical products. The pharmaceutical market in these regions is projected to grow at a rate of around 8% annually, driven by factors such as increasing healthcare access and a growing population. As these markets expand, the demand for pharmaceutical-grade silica gel is expected to rise, providing opportunities for manufacturers to establish a strong presence in these burgeoning regions.

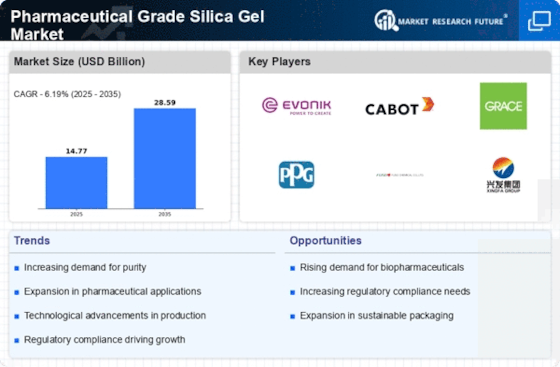

Increasing Pharmaceutical Production

The Pharmaceutical Grade Silica Gel Market is experiencing a notable surge due to the increasing production of pharmaceuticals. As the demand for medications rises, manufacturers are seeking high-quality excipients to enhance drug formulation. Silica gel, known for its excellent adsorption properties, plays a crucial role in stabilizing active pharmaceutical ingredients. In recent years, the pharmaceutical sector has expanded significantly, with a projected growth rate of approximately 5% annually. This growth is likely to drive the demand for pharmaceutical-grade silica gel, as companies prioritize quality and efficacy in their products. Furthermore, the rise in chronic diseases necessitates the development of innovative drug formulations, further propelling the need for specialized excipients like silica gel.

Rising Demand for Personalized Medicine

The Pharmaceutical Grade Silica Gel Market is also being shaped by the rising demand for personalized medicine. As healthcare shifts towards tailored treatments, the need for specialized formulations has become paramount. Silica gel, with its versatile properties, can be customized to meet the specific requirements of various drug formulations. This adaptability is particularly beneficial in the development of personalized therapies, which often require precise dosing and stability. The trend towards personalized medicine is expected to grow, with projections indicating a market expansion of approximately 10% in the coming years. Consequently, the demand for pharmaceutical-grade silica gel is likely to increase as manufacturers seek to create innovative and effective personalized treatment options.

Regulatory Compliance and Quality Standards

The Pharmaceutical Grade Silica Gel Market is heavily influenced by stringent regulatory requirements and quality standards imposed by health authorities. These regulations ensure that pharmaceutical products meet safety and efficacy benchmarks, thereby increasing the demand for high-purity excipients. Silica gel, when produced to pharmaceutical standards, offers a reliable solution for drug manufacturers aiming to comply with these regulations. The increasing focus on quality assurance in the pharmaceutical sector has led to a heightened demand for excipients that can meet these rigorous standards. As a result, manufacturers are investing in advanced production techniques to ensure that their silica gel products adhere to the necessary guidelines, thereby enhancing their market presence.