Advancements in Data Analytics

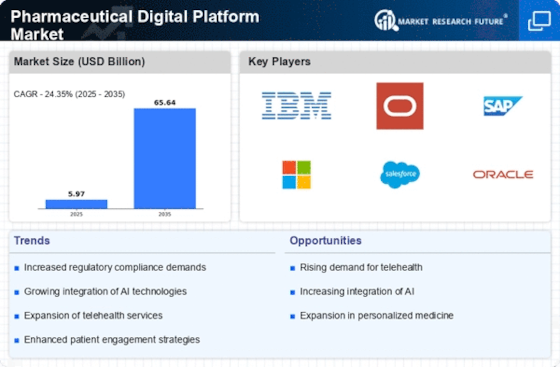

Advancements in data analytics are significantly influencing the Pharmaceutical Digital Platform Market. The ability to harness vast amounts of data allows pharmaceutical companies to gain insights into patient behaviors, treatment outcomes, and market trends. This analytical capability is crucial for developing targeted therapies and personalized medicine approaches. Recent estimates suggest that the global market for healthcare analytics is expected to exceed 50 billion dollars by 2026, reflecting the growing importance of data-driven decision-making in the pharmaceutical sector. Consequently, companies are increasingly adopting digital platforms that integrate advanced analytics, enabling them to optimize their operations and enhance patient outcomes within the Pharmaceutical Digital Platform Market.

Rising Demand for Telehealth Services

The Pharmaceutical Digital Platform Market is experiencing a notable surge in demand for telehealth services. This trend is driven by the increasing preference for remote consultations and digital health solutions among patients and healthcare providers. According to recent data, the telehealth market is projected to reach a valuation of approximately 250 billion dollars by 2028, indicating a robust growth trajectory. This shift towards telehealth not only enhances accessibility but also aligns with the evolving expectations of patients who seek convenience and efficiency in healthcare delivery. As a result, pharmaceutical companies are increasingly investing in digital platforms that facilitate telehealth services, thereby transforming the landscape of patient care and engagement within the Pharmaceutical Digital Platform Market.

Growing Emphasis on Patient Engagement

The Pharmaceutical Digital Platform Market is increasingly characterized by a growing emphasis on patient engagement. Pharmaceutical companies are recognizing that active patient participation in their healthcare journey can lead to improved treatment adherence and outcomes. Digital platforms that facilitate communication between patients and healthcare providers are becoming essential tools in this regard. Recent studies indicate that patient engagement strategies can enhance medication adherence rates by up to 30%. As a result, pharmaceutical companies are investing in digital solutions that empower patients to take an active role in their health management. This trend not only fosters better health outcomes but also drives innovation within the Pharmaceutical Digital Platform Market.

Regulatory Support for Digital Health Initiatives

Regulatory support for digital health initiatives is playing a pivotal role in shaping the Pharmaceutical Digital Platform Market. Governments and regulatory bodies are increasingly recognizing the importance of digital solutions in improving healthcare outcomes. Initiatives aimed at streamlining the approval processes for digital health technologies are being implemented, which encourages innovation and adoption. For instance, recent regulatory frameworks have been established to facilitate the integration of digital therapeutics into standard care practices. This supportive environment is likely to accelerate the development and deployment of digital platforms, ultimately enhancing the capabilities of pharmaceutical companies to deliver effective solutions within the Pharmaceutical Digital Platform Market.

Increased Investment in Digital Health Technologies

The Pharmaceutical Digital Platform Market is witnessing a surge in investment in digital health technologies. Venture capital funding for digital health startups has reached unprecedented levels, with investments surpassing 20 billion dollars in recent years. This influx of capital is fostering innovation and the development of new digital solutions that enhance patient engagement, streamline clinical trials, and improve drug delivery systems. As pharmaceutical companies recognize the potential of digital health technologies to transform their operations and patient interactions, they are increasingly integrating these solutions into their business models. This trend not only drives growth within the Pharmaceutical Digital Platform Market but also enhances the overall efficiency and effectiveness of healthcare delivery.