Growth in Water and Wastewater Treatment

The water and wastewater treatment industry is experiencing significant growth, driven by the need for effective management of water resources and environmental sustainability. PFA lined valves are gaining traction in this sector due to their ability to handle aggressive chemicals and ensure leak-free operations. The Global PFA Lined Valves Industry is likely to see a surge in demand as municipalities and private companies invest in upgrading their infrastructure. Recent data indicates that the market for water treatment equipment is expected to expand at a compound annual growth rate of 6% over the next five years. This growth is attributed to increasing regulatory pressures and the necessity for efficient treatment processes, making PFA lined valves an essential component in modern water management systems.

Rising Focus on Food and Beverage Safety

The food and beverage industry is placing an increasing emphasis on safety and hygiene, which is driving the demand for PFA lined valves. These valves are ideal for applications requiring stringent sanitary standards, as they prevent contamination and ensure product integrity. The Global PFA Lined Valves Industry is poised to benefit from this trend, as manufacturers seek to comply with food safety regulations and enhance their production processes. Market Research Future suggests that the food processing equipment market is projected to grow by 4% annually, with PFA lined valves playing a crucial role in maintaining quality and safety. As consumer awareness regarding food safety rises, the adoption of advanced valve technologies is expected to increase, further solidifying the position of PFA lined valves in this sector.

Expansion of Pharmaceutical Manufacturing

The pharmaceutical manufacturing sector is undergoing rapid expansion, necessitating the use of high-performance equipment that meets stringent regulatory requirements. PFA lined valves are increasingly favored for their ability to handle corrosive substances and maintain the purity of pharmaceutical products. The Global PFA Lined Valves Industry is likely to experience growth as pharmaceutical companies invest in advanced manufacturing technologies. Recent estimates indicate that the pharmaceutical equipment market is set to grow at a rate of 5.5% per year, driven by the need for efficient and compliant production processes. As the industry evolves, the demand for reliable valve solutions that can withstand harsh conditions will continue to rise, positioning PFA lined valves as a critical component in pharmaceutical manufacturing.

Increasing Adoption in Oil and Gas Sector

The oil and gas sector is witnessing a notable increase in the adoption of PFA lined valves due to their superior resistance to corrosive substances and high temperatures. This trend is particularly evident in upstream and downstream operations where the integrity of equipment is paramount. The Global PFA Lined Valves Industry is projected to benefit from this shift, as companies seek to enhance operational efficiency and safety. The demand for reliable and durable valves is expected to rise, with market analysts estimating a growth rate of approximately 5% annually in this sector. As exploration and production activities expand, the need for advanced valve solutions becomes increasingly critical, positioning PFA lined valves as a preferred choice for industry players.

Technological Innovations in Valve Design

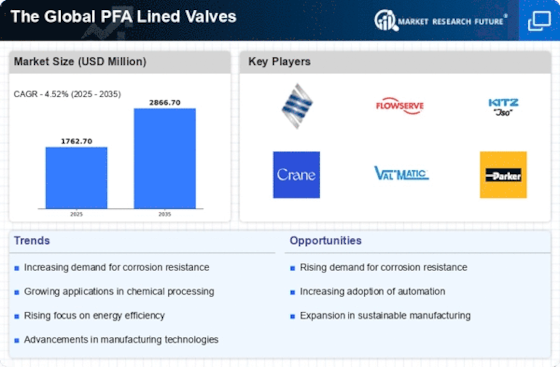

Technological innovations are reshaping the landscape of the valve industry, with PFA lined valves benefiting from advancements in design and materials. These innovations enhance the performance and longevity of valves, making them more appealing to various industries. The Global PFA Lined Valves Industry is expected to see increased adoption of these advanced solutions as companies seek to improve operational efficiency and reduce maintenance costs. Recent trends indicate that the market for innovative valve technologies is growing at a rate of 4.5% annually, driven by the need for more efficient and reliable equipment. As industries continue to evolve, the integration of cutting-edge technologies in valve design will likely play a pivotal role in shaping the future of PFA lined valves.