Aging Population

The increasing proportion of elderly individuals in various regions appears to be a primary driver for the Personal Mobility Devices Market. As people age, mobility challenges often arise, necessitating the use of assistive devices. According to recent demographic data, the population aged 65 and older is projected to reach 1.5 billion by 2050, which indicates a growing demand for mobility solutions. This demographic shift is likely to spur innovation and investment in personal mobility devices, as manufacturers seek to cater to the specific needs of older adults. Furthermore, the rise in age-related health issues, such as arthritis and reduced physical strength, further emphasizes the necessity for effective mobility aids. Consequently, the Personal Mobility Devices Market is expected to expand significantly to accommodate this demographic trend.

Technological Advancements

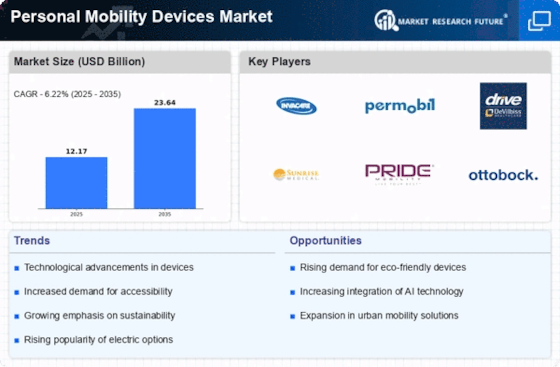

Technological advancements are transforming the landscape of the Personal Mobility Devices Market. Innovations in battery technology, materials science, and smart features are enhancing the functionality and appeal of mobility devices. For instance, the integration of IoT technology allows for real-time tracking and monitoring of device performance, which could improve user experience and safety. Moreover, advancements in lightweight materials are making devices more portable and easier to use. Market data indicates that the electric mobility segment is expected to witness a compound annual growth rate of over 10% in the coming years, driven by these technological improvements. As manufacturers continue to invest in research and development, the Personal Mobility Devices Market is likely to see a surge in new products that cater to diverse consumer needs.

Government Initiatives and Funding

Government initiatives and funding aimed at improving accessibility and mobility for all citizens are likely to bolster the Personal Mobility Devices Market. Various governments are recognizing the importance of inclusive transportation solutions, leading to policies that support the development and distribution of personal mobility devices. For instance, funding programs aimed at enhancing public transportation accessibility can indirectly promote the use of personal mobility devices. Additionally, regulations mandating the inclusion of mobility aids in public spaces are becoming more prevalent. This supportive regulatory environment may encourage manufacturers to innovate and expand their product offerings. As a result, the Personal Mobility Devices Market is expected to thrive, driven by both public and private sector investments in mobility solutions.

Increased Awareness of Health and Wellness

There is a growing awareness of health and wellness among consumers, which appears to be a significant driver for the Personal Mobility Devices Market. As individuals become more conscious of their physical health, the demand for devices that promote mobility and independence is likely to rise. This trend is particularly evident among younger populations who are increasingly seeking solutions that enhance their active lifestyles. Market Research Future indicates that the fitness and wellness sector is expanding, with consumers willing to invest in products that support their health goals. Consequently, personal mobility devices that align with this health-conscious mindset may experience increased adoption. The Personal Mobility Devices Market stands to benefit from this shift, as manufacturers develop products that not only assist with mobility but also promote overall well-being.

Urbanization and Infrastructure Development

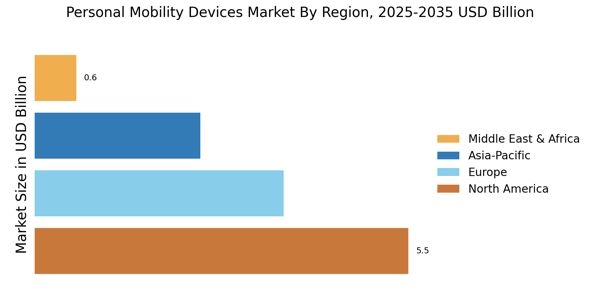

Rapid urbanization and the corresponding development of infrastructure are likely to influence the Personal Mobility Devices Market positively. As urban areas become more densely populated, the need for efficient and compact mobility solutions increases. Data suggests that by 2050, nearly 68% of the world's population will reside in urban areas, leading to heightened demand for personal mobility devices that can navigate crowded environments. Additionally, cities are increasingly investing in pedestrian-friendly infrastructure, such as bike lanes and walkable spaces, which may further encourage the adoption of personal mobility devices. This trend indicates a shift towards sustainable transportation options, where personal mobility devices play a crucial role in enhancing urban mobility. Therefore, the Personal Mobility Devices Market is poised for growth as urban planners and consumers alike recognize the benefits of integrating these devices into daily life.