Increased Focus on Data Security and Privacy

In the Personal Finance Software Market, the heightened focus on data security and privacy is becoming increasingly critical. With the rise of cyber threats, consumers are more cautious about sharing their financial information. Software providers are responding by implementing robust security measures, such as encryption and two-factor authentication, to protect user data. According to recent surveys, nearly 70% of users prioritize security features when selecting personal finance software. This emphasis on data protection not only builds consumer trust but also drives the demand for software that prioritizes user privacy, thereby influencing the competitive landscape of the Personal Finance Software Market.

Growing Popularity of Subscription-Based Models

The Personal Finance Software Market is witnessing a shift towards subscription-based models, which are becoming increasingly popular among consumers. This model allows users to access premium features and updates without a significant upfront investment. Recent statistics suggest that subscription services account for over 40% of the market share in personal finance software. This trend is appealing to users who prefer flexibility and continuous access to the latest tools and resources. As more companies adopt this model, it is likely to reshape the pricing strategies within the Personal Finance Software Market, making it more accessible to a wider audience.

Rising Consumer Awareness of Financial Management

The Personal Finance Software Market is experiencing a notable surge in consumer awareness regarding financial management. As individuals increasingly recognize the importance of budgeting, saving, and investing, the demand for personal finance software has escalated. Recent data indicates that approximately 60% of consumers actively seek tools to enhance their financial literacy. This trend is likely to drive the adoption of personal finance software, as users look for solutions that provide insights into their spending habits and investment opportunities. Furthermore, the emphasis on financial education in schools and communities is fostering a culture of proactive financial management, which could further propel the growth of the Personal Finance Software Market.

Technological Advancements in Software Development

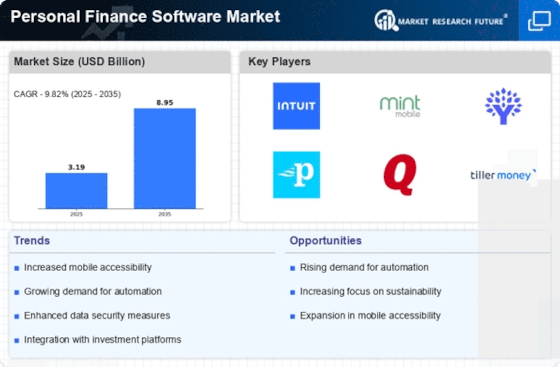

Technological advancements are playing a pivotal role in shaping the Personal Finance Software Market. Innovations in software development, particularly in areas such as artificial intelligence and machine learning, are enhancing the functionality and user experience of personal finance applications. For instance, predictive analytics can now offer users tailored financial advice based on their spending patterns. The market is projected to grow at a compound annual growth rate of 10% over the next five years, driven by these technological improvements. As software becomes more sophisticated, it is likely to attract a broader audience, including those who may have previously been hesitant to engage with personal finance tools.

Integration of Financial Services within Software Platforms

The integration of financial services within personal finance software platforms is emerging as a key driver in the Personal Finance Software Market. Users are increasingly seeking comprehensive solutions that not only help with budgeting but also facilitate investment management, tax preparation, and retirement planning. This trend is reflected in the growing number of software that offers all-in-one financial solutions. Market analysis indicates that platforms providing integrated services are likely to capture a larger share of the market, as they meet the diverse needs of consumers. This holistic approach to personal finance could significantly influence user engagement and retention in the Personal Finance Software Market.