Regulatory Support for Biologics

The evolving regulatory landscape is providing substantial support for the development of biologics, including peptides and oligonucleotides, thereby impacting the Peptide and Oligonucleotide CDMO Market. Regulatory agencies are increasingly recognizing the therapeutic potential of these compounds and are streamlining approval processes. This supportive environment encourages pharmaceutical companies to invest in the development of peptide and oligonucleotide-based therapies. Recent regulatory initiatives aimed at expediting the review of biologics are likely to enhance the attractiveness of these therapies. As a result, CDMOs are positioned to play a critical role in navigating the regulatory complexities, ensuring compliance, and facilitating the timely market entry of innovative products.

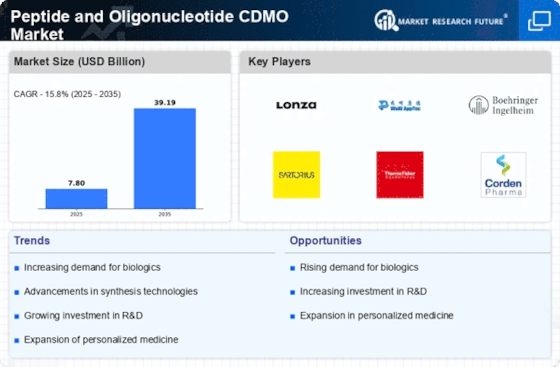

Growing Investment in Biotechnology

The surge in investment within the biotechnology sector is a crucial driver for the Peptide and Oligonucleotide CDMO Market. Venture capital and private equity funding have been directed towards biotechnology firms focusing on peptide and oligonucleotide therapeutics. This influx of capital is facilitating research and development activities, enabling companies to explore new therapeutic avenues. Recent statistics reveal that biotechnology investments have reached unprecedented levels, indicating a robust interest in innovative drug development. As biotechnology firms seek to leverage the capabilities of CDMOs for efficient manufacturing processes, the Peptide and Oligonucleotide CDMO Market is poised for significant expansion, driven by this financial momentum.

Rising Demand for Targeted Therapies

The increasing demand for targeted therapies is reshaping the landscape of the Peptide and Oligonucleotide CDMO Market. Patients and healthcare providers are increasingly favoring treatments that offer precision and reduced side effects. Peptides and oligonucleotides are particularly well-suited for targeted therapies due to their ability to interact specifically with biological targets. Market analysis suggests that the shift towards personalized medicine is driving pharmaceutical companies to invest in the development of these therapies. Consequently, CDMOs specializing in peptide and oligonucleotide production are becoming vital players in the market, as they provide the necessary infrastructure and expertise to meet this growing demand.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a pivotal driver for the Peptide and Oligonucleotide CDMO Market. As these conditions become more prevalent, there is a corresponding demand for innovative therapeutic solutions, including peptide and oligonucleotide-based drugs. According to recent data, the global burden of chronic diseases is expected to increase, necessitating advanced treatment options. This trend compels pharmaceutical companies to collaborate with contract development and manufacturing organizations (CDMOs) to expedite the development and production of these specialized therapies. Consequently, the Peptide and Oligonucleotide CDMO Market is likely to experience substantial growth as it caters to the urgent need for effective treatments.

Advancements in Biopharmaceutical Research

The ongoing advancements in biopharmaceutical research are significantly influencing the Peptide and Oligonucleotide CDMO Market. Innovations in drug discovery and development methodologies, particularly in the fields of genomics and proteomics, are leading to the identification of novel therapeutic targets. This evolution is fostering an environment where peptides and oligonucleotides are increasingly recognized for their therapeutic potential. Market data indicates that the biopharmaceutical sector is projected to expand, with a notable increase in the number of peptide and oligonucleotide-based drugs entering clinical trials. As a result, CDMOs are becoming essential partners in the development process, providing the necessary expertise and resources to bring these innovative therapies to market.