Growth in Automotive Electronics

The Soldering Equipment Market is significantly impacted by the expansion of automotive electronics. With the automotive sector increasingly integrating advanced electronic systems, the demand for reliable soldering solutions is on the rise. In 2025, the automotive electronics market is anticipated to reach a valuation of over 400 billion dollars, reflecting a substantial increase in the need for soldering equipment. This growth is attributed to the proliferation of electric vehicles and the incorporation of smart technologies in traditional vehicles. Consequently, manufacturers of soldering equipment are likely to innovate and adapt their products to cater to the specific requirements of automotive applications, thereby enhancing their market position.

Rising Demand for Consumer Electronics

The Soldering Equipment Market is experiencing a notable surge in demand driven by the increasing production of consumer electronics. As technology advances, devices such as smartphones, tablets, and wearables require sophisticated soldering techniques to ensure reliability and performance. In 2025, the consumer electronics sector is projected to grow at a compound annual growth rate of approximately 6.5%, which directly influences the soldering equipment market. Manufacturers are investing in advanced soldering technologies to meet the quality standards expected by consumers. This trend indicates a robust future for the soldering equipment market, as companies strive to enhance their production capabilities to keep pace with consumer expectations.

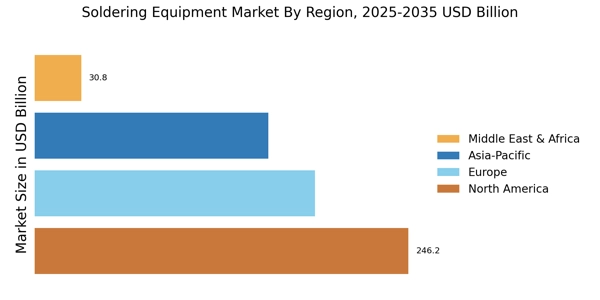

Emerging Markets and Economic Development

The Soldering Equipment Market is benefiting from the economic development of emerging markets. As countries in Asia, Africa, and Latin America continue to industrialize, the demand for electronic products is rising. This growth is fostering an increased need for soldering equipment to support local manufacturing capabilities. In 2025, it is anticipated that these emerging markets will contribute significantly to the overall growth of the soldering equipment market. Manufacturers are likely to explore opportunities in these regions, adapting their products to meet local needs and preferences. This trend indicates a potential for expansion and diversification within the soldering equipment market.

Increased Focus on Quality and Reliability

The Soldering Equipment Market is experiencing a heightened emphasis on quality and reliability in electronic manufacturing. As industries become more quality-conscious, the demand for high-performance soldering equipment is escalating. Companies are increasingly adopting stringent quality control measures to ensure that their products meet international standards. This trend is particularly evident in sectors such as aerospace and medical devices, where the cost of failure can be catastrophic. In 2025, the market for high-quality soldering equipment is projected to grow as manufacturers prioritize reliability in their production processes. This focus on quality is likely to drive innovation and investment in the soldering equipment market.

Technological Advancements in Soldering Equipment

The Soldering Equipment Market is witnessing rapid technological advancements that are reshaping the landscape of soldering processes. Innovations such as laser soldering, selective soldering, and advanced reflow soldering techniques are becoming increasingly prevalent. These technologies not only improve the efficiency and precision of soldering operations but also reduce the risk of defects in electronic assemblies. As manufacturers seek to enhance productivity and maintain high-quality standards, the adoption of these advanced soldering technologies is expected to rise. This trend suggests a promising outlook for the soldering equipment market, as companies invest in state-of-the-art solutions to remain competitive in a fast-evolving industry.