Market Growth Projections

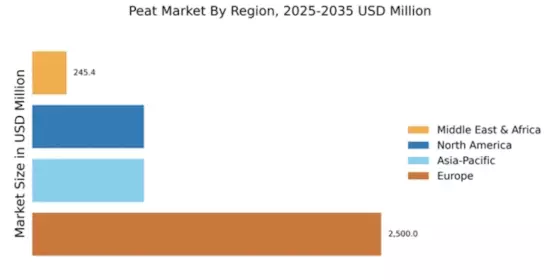

The Global Peat Market Industry is projected to experience substantial growth, with estimates indicating a market value of 4.35 USD Billion in 2024 and a potential increase to 7.1 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 4.56% from 2025 to 2035. Such projections reflect the increasing utilization of peat across various sectors, including horticulture, agriculture, and environmental management. The anticipated growth underscores the importance of peat as a resource, highlighting its multifaceted applications and the ongoing demand for quality peat products in the global market.

Expansion of the Agricultural Sector

The agricultural sector's expansion significantly impacts the Global Peat Market Industry, as peat serves as a vital component in soil conditioning and improving crop yields. With the global population projected to reach 9.7 billion by 2050, the demand for food production intensifies, necessitating the use of peat to enhance soil fertility. Peat Market's ability to retain moisture and nutrients makes it an invaluable resource for farmers. As agricultural practices evolve, the integration of peat into farming systems is expected to grow, further driving market growth. This trend underscores the importance of peat in supporting global food security initiatives.

Rising Demand for Horticultural Products

The Global Peat Market Industry experiences a notable increase in demand for horticultural products, driven by the growing interest in gardening and landscaping. As urbanization progresses, more individuals seek to enhance their living spaces with plants, leading to a surge in the use of peat-based substrates. In 2024, the market is valued at approximately 4.35 USD Billion, with projections indicating a rise to 7.1 USD Billion by 2035. This trend suggests a compound annual growth rate (CAGR) of 4.56% from 2025 to 2035, highlighting the essential role of peat in supporting the horticultural sector's expansion globally.

Regulatory Framework and Supportive Policies

The Global Peat Market Industry is influenced by regulatory frameworks and supportive policies aimed at promoting sustainable practices. Governments worldwide are implementing regulations that encourage responsible peat extraction and usage, fostering a more sustainable market environment. These policies often include incentives for companies that adopt eco-friendly practices, such as rewetting peatlands and reducing carbon emissions. As a result, the industry is likely to benefit from increased investment and innovation, driving growth in the coming years. The alignment of regulatory efforts with market demands suggests a promising future for the peat industry, as it navigates the complexities of sustainability and economic viability.

Technological Advancements in Peat Processing

Technological advancements in peat processing are reshaping the Global Peat Market Industry, enhancing efficiency and product quality. Innovations in extraction and processing techniques allow for more sustainable practices, reducing waste and energy consumption. For instance, the implementation of precision agriculture technologies enables farmers to utilize peat more effectively, optimizing its benefits in crop production. These advancements not only improve the economic viability of peat products but also align with the increasing demand for high-quality horticultural and agricultural substrates. As technology continues to evolve, the industry is poised for growth, adapting to the changing needs of consumers and producers alike.

Environmental Awareness and Sustainable Practices

There is a growing awareness regarding environmental sustainability, which influences the Global Peat Market Industry. Consumers and businesses alike are increasingly prioritizing eco-friendly products, leading to a shift towards sustainable peat extraction methods. This trend is evident as companies adopt practices that minimize ecological impact, such as responsible harvesting and restoration of peatlands. The emphasis on sustainability not only enhances the market's reputation but also aligns with global initiatives aimed at reducing carbon footprints. Consequently, the industry is likely to see a steady increase in demand for sustainably sourced peat products, reinforcing its position in the global market.