Global Trade Dynamics

Global trade dynamics significantly affect the Global Distillers Grains Industry. The international demand for distillers grains is influenced by trade agreements, tariffs, and export policies. Countries with robust livestock sectors, such as China and Mexico, are increasingly importing distillers grains to meet their feed requirements. This trend is likely to bolster market growth, as producers seek to capitalize on export opportunities. The interplay between domestic production and international demand shapes the market landscape, potentially leading to fluctuations in pricing and availability. As trade relationships evolve, the market is poised for continued expansion.

Rising Demand for Animal Feed

The Global Distillers Grains Industry experiences a notable increase in demand for high-protein animal feed. Distillers grains, a byproduct of ethanol production, serve as a valuable feed ingredient for livestock, particularly in regions with intensive animal farming. As the global population continues to grow, the need for sustainable and efficient animal feed sources becomes paramount. In 2024, the market is projected to reach 12.1 USD Billion, reflecting the growing reliance on distillers grains to meet protein requirements in animal nutrition. This trend is likely to persist, as livestock producers seek cost-effective alternatives to traditional feed ingredients.

Sustainability and Environmental Concerns

Sustainability plays a crucial role in shaping the Global Distillers Grains Industry. The increasing emphasis on environmentally friendly practices drives the adoption of distillers grains, which contribute to reduced waste in the ethanol production process. By utilizing these byproducts, producers can minimize their carbon footprint and enhance resource efficiency. Furthermore, consumers are becoming more conscious of the environmental impact of their food choices, prompting a shift towards sustainable animal feed options. This trend aligns with the projected growth of the market, which is expected to reach 20.4 USD Billion by 2035, indicating a long-term commitment to sustainable agricultural practices.

Expansion of Ethanol Production Facilities

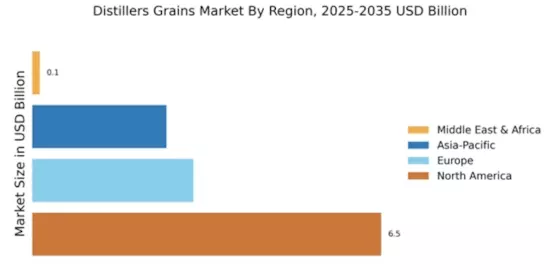

The expansion of ethanol production facilities worldwide has a direct impact on the Global Distillers Grains Industry. As more facilities come online, the volume of distillers grains available for use as animal feed increases, thereby supporting market growth. Regions such as North America and Brazil are witnessing significant investments in ethanol production, driven by favorable government policies and a shift towards renewable energy sources. This expansion not only enhances the supply of distillers grains but also strengthens the overall agricultural economy. The anticipated growth in the market underscores the interconnectedness of renewable energy and agricultural sectors.

Technological Advancements in Ethanol Production

Technological innovations in ethanol production significantly influence the Global Distillers Grains Industry. Enhanced fermentation processes and improved extraction techniques lead to higher yields of distillers grains, making them more economically viable for producers. These advancements not only increase the availability of distillers grains but also improve their nutritional profile, making them more appealing as animal feed. As the industry evolves, the integration of cutting-edge technologies is likely to drive market growth, with a projected compound annual growth rate (CAGR) of 4.83% from 2025 to 2035. This growth trajectory underscores the importance of innovation in meeting global feed demands.