Top Industry Leaders in the PC Based Automation Market

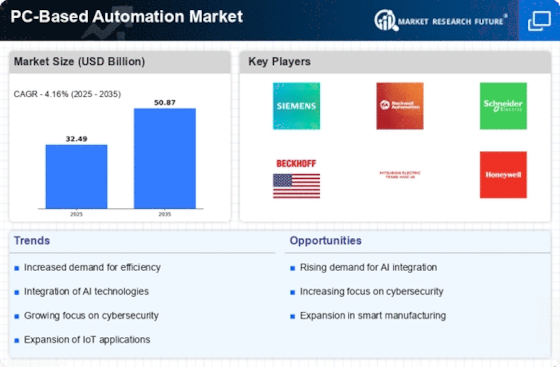

The Competitive Landscape of PC-Based Automation:

The PC-based automation market, encompassing control systems powered by industrial PCs, hums with a dynamic interplay of established players and ambitious newcomers. Understanding this competitive landscape is crucial for anyone strategizing within this technology-driven domain.

Strategies Adopted by Key Players:

Global industrial heavyweights like Siemens, ABB, GE, and Rockwell Automation dominate the market, leveraging their extensive experience, brand recognition, and established distribution networks. Their strategies revolve around:

- Product innovation: Continuously developing cutting-edge hardware and software solutions, including modular controllers, open-source platforms, and edge computing capabilities.

- Strategic acquisitions: Expanding their portfolios through targeted acquisitions of niche players or technology leaders to gain access to new markets and expertise.

- Vertical specialization: Tailoring offerings to specific industries like automotive, food and beverage, and pharmaceuticals to cater to unique automation needs.

- Partnerships and alliances: Collaborating with system integrators, software vendors, and cloud providers to offer comprehensive automation solutions and reach a wider customer base.

Factors Shaping Market Share Analysis:

Understanding market share dynamics is crucial for assessing competitive positioning. Key factors to consider include:

- Geographic distribution: Market penetration varies across regions, with Asia Pacific leading the charge due to rapid industrialization.

- Industry focus: Different industries have varying automation needs, influencing vendor preferences. For instance, discrete manufacturing might favor Beckhoff's modular solutions, while process industries might lean towards Honeywell's process control expertise.

- Technology adoption: Companies embracing cutting-edge technologies like AI, machine learning, and IIoT gain an edge, while those lagging behind lose ground.

- Price sensitivity: While cost remains a crucial factor, value propositions emphasizing efficiency, scalability, and long-term ROI are gaining traction.

New and Emerging Players:

The market is witnessing a surge of innovative startups and smaller companies carving their niches. These players often excel in:

- Niche expertise: Offering specialized solutions for specific automation tasks or industries, often at competitive prices.

- Cloud-based solutions: Providing SaaS-based automation platforms with flexible pricing models and ease of deployment, appealing to smaller businesses.

- Open-source technologies: Leveraging open-source platforms and standards to offer customizable and interoperable solutions, attracting tech-savvy customers.

- Agility and innovation: Responding quickly to market trends and developing disruptive technologies, challenging established players with fresh perspectives.

Industry Developments

ABB:

- October 25, 2023: Launched ABB AbilityTM Symphony Plus 2.0, a new version of its PC-based automation system offering improved scalability, performance, and security.

- June 21, 2023: Announced collaboration with Microsoft to integrate ABB AbilityTM solutions with Microsoft Azure cloud platform for industrial IoT applications.

- April 19, 2023: Partnered with NVIDIA to develop AI-powered solutions for predictive maintenance and process optimization in industrial automation.

Yokogawa Electric:

- November 8, 2023: Showcased its EXILIM family of PC-based control systems at MESCOT automation trade show, highlighting features like edge computing capabilities and open architecture.

- September 20, 2023: Announced release of FAST/FastS DCS R7.01, an update to its flagship PC-based automation system with enhanced security features and integration with cloud platforms.

- July 6, 2023: Partnered with C3.ai to develop AI-based solutions for anomaly detection and predictive maintenance in industrial processes.