Market Trends

Key Emerging Trends in the Patient Registry Software Market

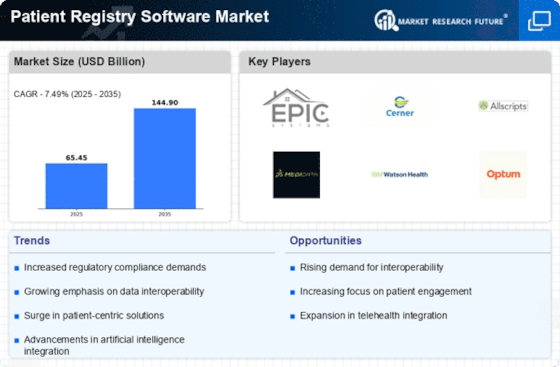

The Patient Registry Software market is growing in popularity because of the rising spotlight on persistent infection management. Healthcare suppliers are taking on registry software to efficiently gather, make due, and examine patient information for conditions like diabetes, cardiovascular infections, and disease, expecting to further develop results and patient consideration. A prominent pattern in the market is the consistent coordination of Patient Registry Software with Electronic Health Records (EHR) frameworks. This coordination improves interoperability, levelling out information sharing and working with a complete perspective on patient health chronicles, adding to more educated decision-production by healthcare professionals. Patient reserves are becoming essential sources of genuine proof for clinical exploration and results studies. Drug organizations and specialists influence registry information to evaluate the adequacy and safety of medicines, speeding up proof-based medication and supporting administrative entries. The joining of portable health advances is acquiring noticeable quality in Patient Registry Software. Versatile applications and wearable gadgets empower patients to contribute information to libraries progressively, advancing persistent checking and permitting healthcare suppliers to catch significant data outside conventional healthcare settings. Healthcare associations are integrating Patient Registry Software into their populace health management techniques. Collections help distinguish in at-risk publics, track health patterns, and execute designated mediations, at last further developing health results at both individual and local area levels. The market is seeing the coordination of cutting-edge investigation apparatuses inside Patient Registry Software. Prescient displaying and information investigation empower healthcare suppliers to recognize patterns, figure illness movement, and distribute assets successfully, adding to proactive and customized patient consideration. Cloud-based Patient Registry Software arrangements are building up momentum because of their versatility, openness, and cost-viability. Cloud stages empower healthcare associations to store and oversee huge volumes of registry information safely while giving the adaptability to scale assets depending on the condition. Patient Registry Software is progressively used in the investigation of uncommon illnesses and the advancement of roaming medicines. Vaults assume a significant part in social occasion information on uncommon circumstances, supporting examination, and working with the improvement of designated treatments for small patient populaces.

Leave a Comment