Emphasis on Value-Based Care Models

The shift towards value-based care models is significantly influencing the Patient Registry Software Market. Healthcare systems are increasingly adopting payment structures that prioritize patient outcomes over service volume. This transition necessitates the collection and analysis of patient data to assess the effectiveness of treatments and interventions. Patient registries serve as vital tools in this context, enabling healthcare providers to track patient outcomes and demonstrate the value of their services. As a result, the demand for patient registry software that supports value-based care initiatives is expected to grow. This trend reflects a broader movement within the healthcare sector towards accountability and quality improvement, further driving the Patient Registry Software Market.

Rising Demand for Data-Driven Insights

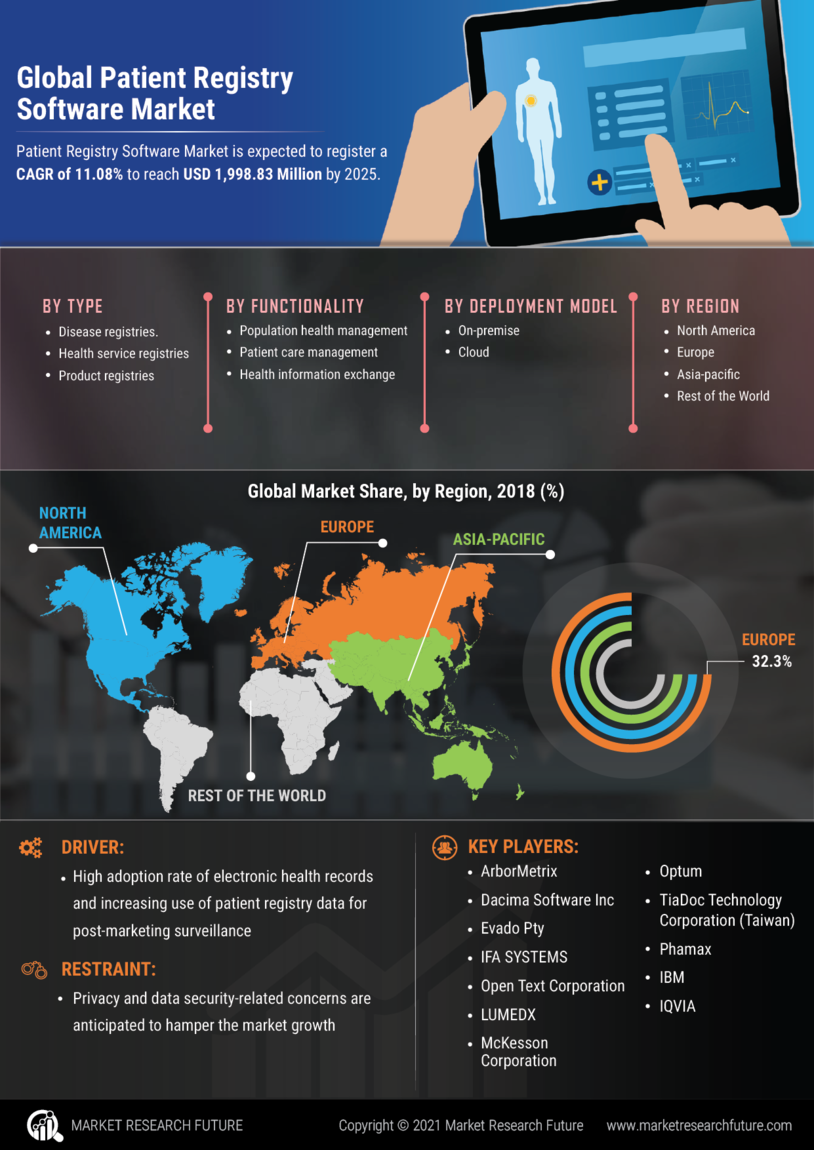

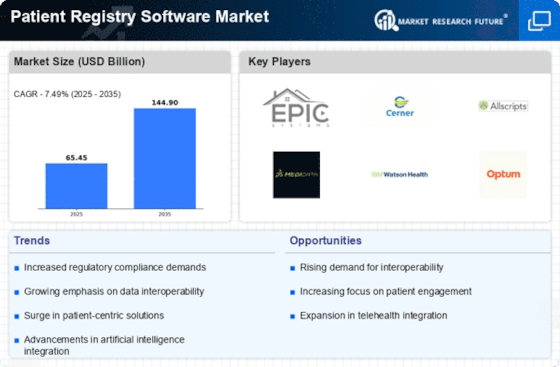

The Patient Registry Software Market is experiencing a notable increase in demand for data-driven insights. Healthcare providers and researchers are increasingly recognizing the value of patient registries in generating actionable data that can inform clinical decisions and improve patient outcomes. According to recent estimates, the market for patient registry software is projected to grow at a compound annual growth rate (CAGR) of approximately 12% over the next five years. This growth is driven by the need for healthcare organizations to leverage data analytics for better patient management and treatment strategies. As healthcare systems strive to enhance efficiency and effectiveness, the integration of patient registries into clinical workflows becomes essential, thereby propelling the Patient Registry Software Market forward.

Technological Advancements in Healthcare

Technological advancements are reshaping the landscape of the Patient Registry Software Market. Innovations such as artificial intelligence, machine learning, and cloud computing are enhancing the capabilities of patient registry software. These technologies enable more efficient data collection, storage, and analysis, allowing healthcare providers to derive insights from large datasets. The integration of advanced analytics tools into patient registries is likely to improve decision-making processes and patient care outcomes. As healthcare organizations increasingly adopt these technologies, the Patient Registry Software Market is poised for substantial growth, driven by the demand for more sophisticated and effective registry solutions.

Regulatory Support for Patient Registries

Regulatory bodies are increasingly recognizing the importance of patient registries in improving healthcare quality and outcomes, which is positively impacting the Patient Registry Software Market. Initiatives aimed at promoting the use of patient registries for research and quality improvement are gaining traction. For instance, various health authorities are providing guidelines and funding to support the establishment and maintenance of patient registries. This regulatory support not only encourages healthcare organizations to adopt registry solutions but also fosters collaboration among stakeholders. As a result, the Patient Registry Software Market is likely to benefit from enhanced investment and innovation, further solidifying the role of patient registries in modern healthcare.

Increased Focus on Chronic Disease Management

Chronic diseases are becoming more prevalent, leading to a heightened focus on effective management strategies within the Patient Registry Software Market. The World Health Organization has reported that chronic diseases account for a significant portion of global mortality, necessitating robust tracking and management solutions. Patient registries play a crucial role in monitoring disease progression, treatment efficacy, and patient adherence to prescribed therapies. As healthcare providers seek to improve outcomes for chronic disease patients, the demand for specialized patient registry software is likely to rise. This trend is expected to contribute to the overall growth of the Patient Registry Software Market, as organizations invest in tools that facilitate comprehensive patient management.